Question: Warren Co. purchased a put option on Echo common shares on January 7, 2012, for $360. The put option is for 400 shares, and the

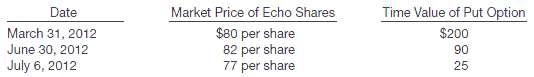

Warren Co. purchased a put option on Echo common shares on January 7, 2012, for $360. The put option is for 400 shares, and the strike price is $85 (which equals the price of an Echo share on the purchase date). The option expires on July 31, 2012. The following data are available with respect to the put option.

InstructionsPrepare the journal entries for Warren Co. for the following dates.(a) January 7, 2012??Investment in put option on Echo shares.(b) March 31, 2012??Warren prepares financial statements.(c) June 30, 2012??Warren prepares financial statements.(d) July 6, 2012??Warren settles the put option on the Echoshares.

Market Price of Echo Shares Time Value of Put Option Date March 31, 2012 June 30, 2012 July 6, 2012 $80 per share 82 per share 77 per share $200 90 25

Step by Step Solution

3.30 Rating (174 Votes )

There are 3 Steps involved in it

a January 7 2012 Put Option 360 Cash 360 b March 31 2012 Put Opt... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-I (168).docx

120 KBs Word File