Question: Weller Industries is a decentralized organization with six divisions. The companys Electrical Division produces a variety of electrical items, including an X52 electrical fitting. The

Weller Industries is a decentralized organization with six divisions. The company’s Electrical Division produces a variety of electrical items, including an X52 electrical fitting. The Electrical

Division (which is operating at capacity) sells this fitting to its regular customers for $7.50 each; the fitting has a variable manufacturing cost of $4.25.

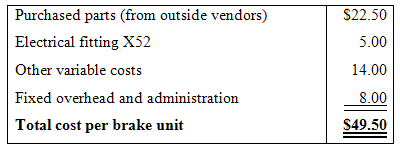

The company’s Brake Division has asked the Electrical Division to supply it with a large quantity of X52 fittings for only $5 each. The Brake Division, which is operating at 50% of capacity, will put the fitting into a brake unit that it will produce and sell to a large commercial airline manufacturer. The cost of the brake unit being built by the Brake Division follows:

Although the $5 price for the X52 fitting represents a substantial discount from the regular $7.50 price, the manager of the Brake Division believes that the price concession is necessary if his division is to get the contract for the airplane brake units. He has heard “through the grapevine” that the airplane manufacturer plans to reject his bid if it is more than $50 per brake unit. Thus, if the Brake Division is forced to pay the regular $7.50 price for the X52 fitting, it will either not get the contract or it will suffer a substantial loss at a time when it is already operating at only 50% of capacity. The manager of the Brake Division argues that the price concession is imperative to the well-being of both his division and the company as a whole. Weller Industries uses return on investment (RU!) to measure divisional performance.

Required:

1. Assume that you are the manager of the Electrical Division. Would you recommend that your division supply the X52 fitting to the Brake Division for $5 each as requested? Why or why not? Show all computations.

2. Would it be profitable for the company as a whole for the Electrical Division to supply the fittings to the Brake Division if the airplane brakes can be sold for $50? Show all computations, and explain your answer.

3. In principle, should it be possible for the two managers to agree to a transfer price in this particular situation? If so, within what range would that transfer price lie?

4. Discuss the organizational and manager behavior problems, if any, inherent in this situation. What would you advise the company’s president to do in this situation?

Purchased parts (from outside vendors) $22.50 Electrical fitting X52 Other variable costs Fixed overhead and administration 5.00 14.00 8.00 Total cost per brake unit $49.50

Step by Step Solution

3.32 Rating (173 Votes )

There are 3 Steps involved in it

1 The Electrical Division is presently operating at capacity therefore any sales of X52 electrical fitting to the Brake Division will require that the Electrical Division give up an equal number of sa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-D-B-S (52).docx

120 KBs Word File