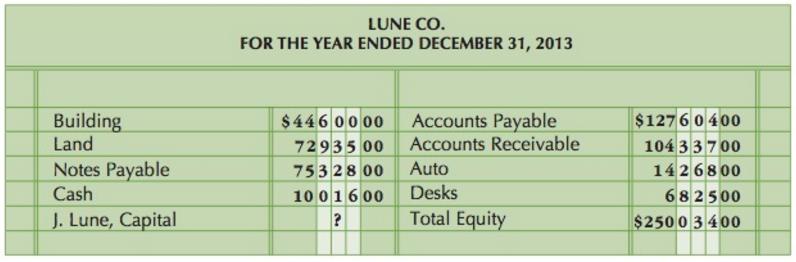

Question: While Jon Lune was on a business trip, he asked Abby Slowe, the book-keeper for Lune Co., to try to complete a balance sheet for

While Jon Lune was on a business trip, he asked Abby Slowe, the book-keeper for Lune Co., to try to complete a balance sheet for the year ended December 31, 2013. Abby, who had been on the job only two months, submitted the following:

1. Help Abby fix as well as complete the balance sheet.

2. What written recommendations would you make about the bookkeeper? Should she be retained?

3. Suppose that (a) Jon Lune invested an additional $20,000 in cash as well as additional desks with a value of $8,000 and (b) Lune Co. bought an auto for $6,000 that was originally marked $8,000, paying $2,000 down and issuing a note for the balance. Prepare an updated balance sheet. Assume that these two transactions occurred on January 4.

LUNE CO. FOR THE YEAR ENDED DECEMBER 31, 2013 Building Land $446 0000 Accounts Payable 72935 00 Accounts Receivable 7532800 Auto 1001 600 Desks $1276 0400 10433700 1426800 682500 $2500 3400 Notes Payable Cash J. Lune, Capital Total Equity

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

1 LUNE CO BALANCE SHEET DECEMBER 31 2013 Solution Continue In Next Page 2 Slowe ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

725-B-A-B-S-C-F (2142).docx

120 KBs Word File