Question: Whirlpool Corporation conducted an activity-based costing study of its Evansville, Indiana, plant in Order to identity its most profitable products. Assume that we select three

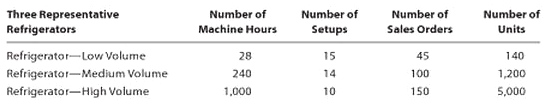

Whirlpool Corporation conducted an activity-based costing study of its Evansville, Indiana, plant in Order to identity its most profitable products. Assume that we select three representative refrigerators (out of 333): One low-, one medium-, and one high-volume refrigerator. Additionally, we assume the following activity-base information for each of the three refrigerators:

Prior to conducting the study, the factory over head allocation was based on single machine hour rate. The machine hour rate was $180 per hour. After conducting the activity-based costing study, assume that three activities were used to allocate the factory overhead. The new activity rate information is assumed to be as follows:

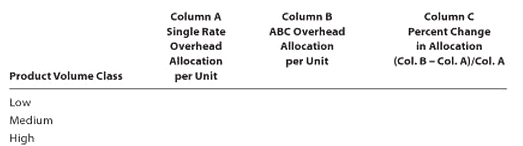

(a) Complete the following table, using the single machine hour rate to determine the per unit factory overhead for each refrigerator ( Column A) and the three activity-based rates to determine the activity-based factory overhead per unit (Column B). Finally, compute the percent change in per-unit overhead to nearest cent and whole percents to one decimal place.

(b) Why is the traditional overhead rate per machine hour greater under the single rate method than under the activity-based method?(c) Interpret Column C in your table from part (a)

Number of Three Representative Refrigerators Number of Setups Number of Number of Machine Hours Sales Orders Units Refrigerator-Low Volume Refrigerator-Medium Volume Refrigerator-High Volume 45 140 28 15 1,200 240 100 14 10 1,000 150 5,000

Step by Step Solution

3.45 Rating (181 Votes )

There are 3 Steps involved in it

a Column A Column B Column C Product Volume Class Single Rate Overhead Allocation per Unit ABC Overhead Allocation per Unit Percent Change in Allocati... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

52-B-C-A-C-A (112).docx

120 KBs Word File