Question: With the notation used in this chapter (a) What is N'(x)? (b) Show that SN'(d 1 ) = Ke r(Tt) N'(d 2 ), where S

With the notation used in this chapter

(a) What is N'(x)?

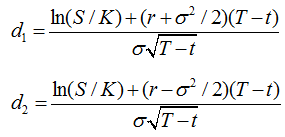

(b) Show that SN'(d1) = Ke–r(T–t)N'(d2), where S is the stock price at time t

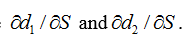

(c) Calculate

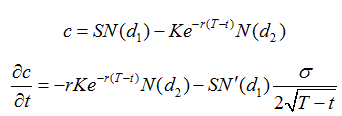

(d) Show that when

where c is the price of a call option on a non-dividend-paying stock.

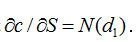

(e) Show that

(f) Show that the c satisfies the Black–Scholes–Merton differential equation.

(g) Show that satisfies the boundary condition for a European call option, i.e., that c = max (S –k, 0) as t tends to T.

In(S /K)+(r+o / 2)(T t) d ONT -t In(S /K)+(r-o / 2)(T t) dz oNT -t d, / S and od, / OS .

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

a Since is the cumulative probability that a variable with a standardized normal distributi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1398-B-C-F-O(1455).docx

120 KBs Word File