Question: Wooler Inc. operates a discount store in a medium-sized Canadian city. At the beginning of 2016, the owner decided to begin accepting major credit cards

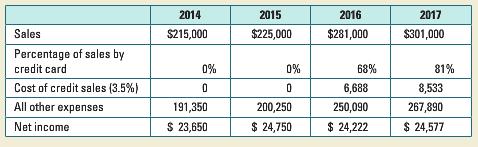

Wooler Inc. operates a discount store in a medium-sized Canadian city. At the beginning of 2016, the owner decided to begin accepting major credit cards in the store. Until then, only cash had been accepted. The owner had been advised by a number of business consultants that by accepting credit cards, sales would increase significantly and, therefore, so would profit. The consult ants were right about sales-they increased significantly-but profits were flat. The owner has come to you for an explanation for the results. She would like to know why profit has remained low despite the increase in sales. She has provided you with the following information:

2014 2015 2016 2017 Sales $215,000 $225,000 $281,000 $301,000 Percentage of sales by credit card 0% 0% 68% 81% Cost of credit sales (3.5%) 6,688 8,533 All other expenses 191,350 200,250 250,090 267,890 Net income $ 23,650 $ 24,750 $ 24,222 $ 24,577

Step by Step Solution

3.38 Rating (179 Votes )

There are 3 Steps involved in it

Wooler Incs profit margin to start off is low roughly 11 of sales for years 2014 and 2015 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

408-B-A-C-R (2673).docx

120 KBs Word File