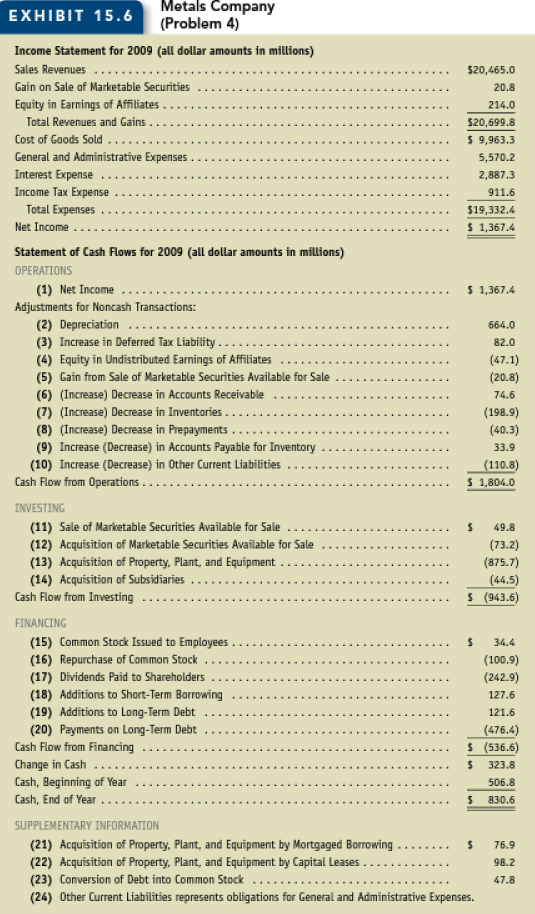

Question: Working backward from the statement of cash flows. Exhibit 15.6 presents an income statement and a statement of cash flows for Metals Company for 2009.

Working backward from the statement of cash flows. Exhibit 15.6 presents an income statement and a statement of cash flows for Metals Company for 2009.

.png)

Give the entry made on the T-account work sheet for each of the numbered line items. For example, the work sheet entry for line (1) is as follows (amounts inmillions):

Metals Company EXHIBIT 15.6 (Problem 4) Income Statement for 2009 (all dollar amounts in millions) Sales Revenues $20,465.0 Gain on Sale of Marketable Securities 20.8 Equity in Earnings of Affiliates . 214.0 Total Revenues and Gains . $20,699.8 Cost of Goods Sold . $ 9,963.3 General and Administrative Expenses Interest Expense .. Income Tax Expense Total Expenses 5,570.2 2,887.3 911.6 $19,332.4 Net Income $ 1,367.4 Statement of Cash Flows for 2009 (all dollar amounts in millions) OPERATIONS $ 1,367.4 (1) Net Income Adjustments for Noncash Transactions: (2) Depreciation ... 664.0 (3) Increase in Deferred Tax Liability .. 82.0 (4) Equity in Undistributed Earnings of Affiliates (47.1) (5) Gain from Sale of Marketable Securities Available for Sale (20.8) (6) (Increase) Decrease in Accounts Receivable 74.6 (7) (Increase) Decrease in Inventories ... (198.9) (8) (Increase) Decrease in Prepayments (40.3) (9) Increase (Decrease) in Accounts Payable for Inventory (10) Increase (Decrease) in Other Current Liabilities Cash Flow from Operations.... 33.9 (110.8) $ 1,804.0 INVESTING (11) Sale of Marketable Securities Available for Sale 49.8 (12) Acquisition of Marketable Securities Available for Sale (73.2) (13) Acquisition of Property, Plant, and Equipment .. (14) Acquisition of Subsidiaries .... Cash Flow from Investing (875.7) (44.5) $ (943.6) FINANCING (15) Common Stock Issued to Employees.. (16) Repurchase of Common Stock (17) Dividends Paid to Shareholders (18) Additions to Short-Term Borrowing (19) Additions to Long-Term Debt (20) Payments on Long-Term Debt Cash Flow from Financing Change in Cash Cash, Beginning of Year Cash, End of Year ... 34.4 (100.9) (242.9) 127.6 121.6 (476.4) $ (536.6) 323.8 506.8 830.6 SUPPLEMENTARY INFORMATION (21) Acquisition of Property, Plant, and Equipment by Mortgaged Borrowing (22) Acquisition of Property, Plant, and Equpment by Capital Leases ... 76.9 98.2 (23) Conversion of Debt into Common Stock 47.8 (24) Other Current Liabilities represents obligations for General and Administrative Expenses.

Step by Step Solution

3.37 Rating (175 Votes )

There are 3 Steps involved in it

Metals Company working backwards from statement of cash flowsBased on financial statements of Alcoa 2 Cash Operations x Depreciation Expense Add back ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

65-B-M-A-S-C-F (376).docx

120 KBs Word File