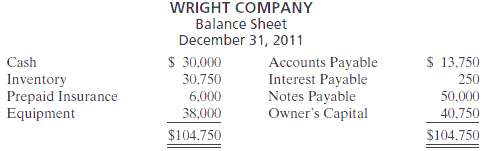

Question: Wright Company?s balance sheet at December 31, 2011, is presented below. During January 2012, the following transactions occurred. (Wright Company uses the perpetual inventory system.)1.

Wright Company?s balance sheet at December 31, 2011, is presented below.

During January 2012, the following transactions occurred. (Wright Company uses the perpetual inventory system.)1. Wright paid $250 interest on the note payable on January 1, 2012. The note is due December 31, 2013.2. Wright purchased $241,100 of inventory on account.3. Wright sold for $480,000 cash, inventory which cost $265,000. Wright also collected $28,800 in sales taxes.4. Wright paid $230,000 in accounts payable.5. Wright paid $17,000 in sales taxes to the state.6. Paid other operating expenses of $20,000.7. On January 31, 2012, the payroll for the month consists of salaries and wages of $60,000. All salaries and wages are subject to 8% FICA taxes. A total of $8,900 federal income taxes are withheld. The salaries and wages are paid on February 1.Adjustment data:8. Interest expense of $250 has been incurred on the notes payable.9. The insurance for the year 2012 was prepaid on December 31, 2011.10. The equipment was acquired on December 31, 2011, and will be depreciated on a straight-line basis over 5 years with a $2,000 salvage value.

11. Employer?s payroll taxes include 8% FICA taxes, a 5.4% state unemployment tax, and an 0.8% federal unemployment tax.

Instructions(You may need to set up T accounts to determine ending balances.)(a) Prepare journal entries for the transactions listed above and the adjusting entries.(b) Prepare an adjusted trial balance at January 31, 2012.

(c) Prepare an income statement, an owner?s equity statement for the month ending January 31, 2012, and a classified balance sheet as of January 31, 2012.

WRIGHT COMPANY Balance Sheet December 31, 2011 Cash $ 30,000 30.750 6,000 Accounts Payable Interest Payable Notes Payable Owner's Capital $ 13.750 250 Inventory Prepaid Insurance Equipment 50.000 40,750 38,000 $104.750 $104.750

Step by Step Solution

3.41 Rating (179 Votes )

There are 3 Steps involved in it

a 1 Interest Payable Cash 250 250 2 Inventory Accounts Payable 241100 241100 3 Cash Sales Revenue Sales Taxes Payable 508800 480000 28800 Cost of Goods Sold Inventory 265000 265000 4 Accounts Payable ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

54-B-A-L (578).docx

120 KBs Word File