Xerox was not having a particularly pleasant year. The company??s stock price had already fallen in the

Question:

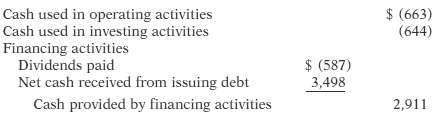

Xerox was not having a particularly pleasant year. The company??s stock price had already fallen in the previous year from $60 per share to $30. Just when it seemed things couldn??t get worse, Xerox??s stock fell to $4 per share. The data below were taken from the statement of cash flows of Xerox. All dollars are in millions.

InstructionsAnalyze the information above, and then answer the following questions.(a) If you were a creditor of Xerox, what reaction might you have to the above information?(b) If you were an investor in Xerox, what reaction might you have to the above information?(c) If you were evaluating the company as either a creditor or a stockholder, what other information would you be interested in seeing?(d) Xerox decided to pay a cash dividend. This dividend was approximately equal to the amount paid in the previous year. Discuss the issues that were probably considered in making thisdecision.

Step by Step Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso