Question: You are considering some put and call options and have available the following data: a. Comparing the two calls, should DEF sell for more or

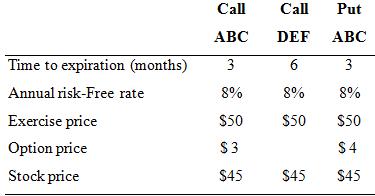

You are considering some put and call options and have available the following data:

a. Comparing the two calls, should DEF sell for more or less than ABC? Why?

b. What is the time value for ABC?

c. Based on the information for the call and the put for ABC, determine if put-call parity is working.

Cal Call Put ABC DEF ABC Time to expiration (months) 3 Annual risk-Free rate Exercise price Option price Stock price 890 890 890 S50 S50 S50 S3 $45 $45 $45 S4

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

a Less because of its higher exercise price b Intrinsic value of Call ABC 45 40 5 Time v... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

650-B-A-I (7630).docx

120 KBs Word File