Question: You are provided with the following transactions that took place during a recent fiscal year. InstructionsComplete the table indicating whether each item (1) Should be

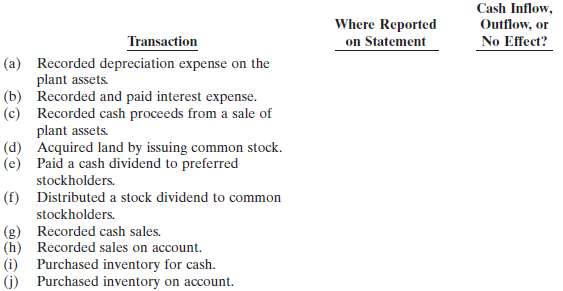

You are provided with the following transactions that took place during a recent fiscal year.

InstructionsComplete the table indicating whether each item (1) Should be reported as an operating (O) activity, investing (I) activity, financing (F) activity, or as a noncash (NC) transaction reported in a separate schedule, and (2) Represents a cash inflow or cash outflow or has no cash flow effect. Assume use of the indirect approach.

Cash Inflow, Outflow, or Where Reported on Statement Transaction No Effect? (a) Recorded depreciation expense on the plant assets (b) Recorded and paid interest expense. (c) Recorded cash proceeds from a sale of plant assets. (d) Acquired land by issuing common stock. (e) Paid a cash dividend to preferred stockholders. (f) stockholders. (g) Recorded sales on account. Distributed a stock dividend to common Recorded cash sales. (h) (i) Purchased inventory for cash. (j) Purchased inventory on account.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Transaction Where Reported Cash Inflow Outflow or No Effect a Re... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-A-B-S-C-F (193).docx

120 KBs Word File