Question: You have been given the following return information for two mutual funds (Papa and Mama), the market index, and the risk-free rate. Calculate the Sharpe

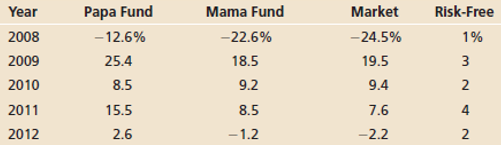

You have been given the following return information for two mutual funds (Papa and Mama), the market index, and the risk-free rate.

Calculate the Sharpe ratio, Treynor ratio, Jensen's alpha, information ratio, and R-squared for both funds and determine which is the best choice for your portfolio.

Market Risk-Free Year 2008 2009 2010 2011 2012 Papa Fund -12.6% 25.4 8.5 15.5 2.6 Mama Fund -22.6% 18.5 9.2 8.5 -24.5% 19.5 9.4 7.6 2.2 1% 4

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Given Data Year Papa Mama Market Riskfree 2008 1260 2260 2450 100 2009 2540 1850 1950 300 2010 8... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1108-B-A-I(8766).xlsx

300 KBs Excel File