Question: You have been presented with selected information taken from the financial statements of Southwest Airlines Co., shown on the next page. Instructions(a) Calculate each of

You have been presented with selected information taken from the financial statements of Southwest Airlines Co., shown on the next page.

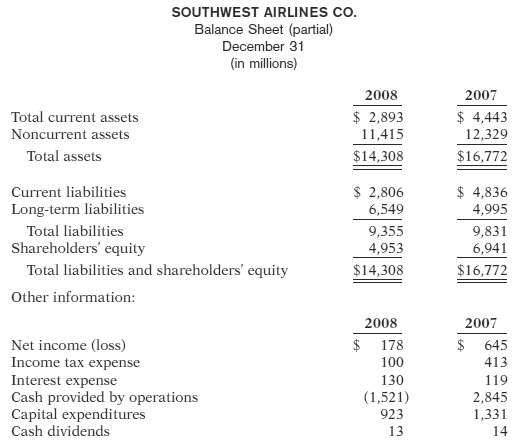

Instructions(a) Calculate each of the following ratios for 2008 and 2007.(1) Current ratio.(2) Free cash flow.(3) Debt to total assets.(4) Times interest earned ratio.(b) Comment on the trend in ratios.(c) Read the company??s note on leases. If the operating leases had instead been accounted for like a purchase, assets and liabilities would increase by approximately $1,600 million. Recalculate the debt to total assets ratio for 2008 in light of this information, and discuss the implictions for analysis.

SOUTHWEST AIRLINES CO. Balance Sheet (partial) December 31 (in millions) 2008 2007 $ 2,893 11,415 $ 4,443 Total current assets Noncurrent assets 12,329 Total assets $14,308 $16,772 $ 2,806 6,549 $ 4,836 4,995 Current liabilities Long-term liabilities Total liabilities 9,355 4,953 9,831 6,941 Shareholders' equity Total liabilities and shareholders' equity $14,308 $16,772 Other information: 2008 2007 $ 178 Net income (loss) Income tax expense 2$ 645 100 413 Interest expense Cash provided by operations Capital expenditures Cash dividends 130 119 (1,521) 2,845 1,331 923 13 14

Step by Step Solution

3.33 Rating (168 Votes )

There are 3 Steps involved in it

a 2008 2007 1 Current ratio 2893 2806 1031 4443 4836 921 2 Free cash flow 1521 923 13 2457 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-A-L (398).docx

120 KBs Word File