1. In a partnership liquidation, the final cash distribution to the partners should be made in accordance...

Question:

1. In a partnership liquidation, the final cash distribution to the partners should be made in accordance with the:

a. Partner profit and loss sharing ratios

b. Balances of partner capital accounts

c. Ratio of the capital contributions by partners

d. Safe payments computations

2. In accounting for the liquidation of a partnership, cash payments to partners after all non-partner creditors' claims have been satisfied, but before final cash distribution, should be according to:

a. Relative profit and loss sharing ratios

b. The final balances in partner capital accounts

c. The relative share of gain or loss on liquidation

d. Safe payments computations

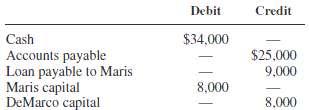

3. After all non-cash assets have been converted into cash in the liquidation of the Maris and DeMarco partnership, the ledger contains the following account balances:

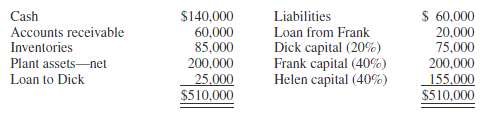

Available cash should be distributed as follows: $25,000 to accounts payable and:a. $9,000 for loan payable to Marisb. $4,500 each to Maris and DeMarcoc. $1,000 to Maris and $8,000 to DeMarcod. $8,000 to Maris and $1,000 to DeMarco4. The partnership of Gwen, Bill, and Sissy is liquidating and the ledger shows the following:Cash .......... $ 80,000Inventories......... 100,000Accounts payable..... 60,000Gwen capital (50%) ... 40,000Bill capital (25%) ...... 45,000Sissy capital (25%).... 35,000If all available cash is distributed immediately:a. Gwen, Bill, and Sissy should get $26,667 eachb. Gwen, Bill, and Sissy should get $6,667 eachc. Gwen should get $10,000, and Bill and Sissy should get $5,000 eachd. Bill should get $15,000, and Sissy $5,0005. The following balance sheet summary, together with residual profit sharing ratios, was developed on April 1, 2011, when the Dick, Frank, and Helen partnership began its liquidation:

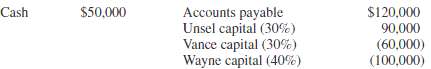

If available cash except for a $5,000 contingency fund is distributed immediately, Dick, Frank, and Helen, respectively, should receive:a. $0, $60,000, and $15,000b. $11,000, $22,000, and $22,000c. $0, $70,000, and $5,000d. $0, $27,500, and $27,5006. The partnership of Unsel, Vance, and Wayne was dissolved on June 30, 2011, and account balances after noncash assets were converted into cash on September 1, 2011, are:

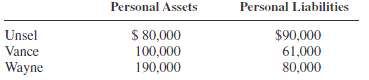

Personal assets and liabilities of the partners at September 1, 2011, are:

If Wayne contributes $70,000 to the partnership to provide cash to pay the creditors, what amount of Unsel's $90,000 partnership equity would appear to be recoverable?a. $90,000b. $81,000c. $79,000d. None of the above

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith