Question: A financial institution has hired three external portfolio managers: X, Y, and Z. All three managers have the same benchmark. A performance attribution analysis of

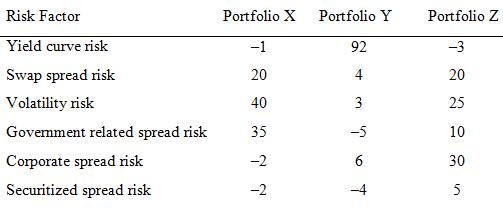

A financial institution has hired three external portfolio managers: X, Y, and Z. All three managers have the same benchmark. A performance attribution analysis of the portfolios managed by the three managers for the past year was (in basis points):

The financial institution’s investment committee is using the above information to assess the performance of the three external managers. Below is a statement from three members of the performance evaluation committee. Respond to each statement.

(a) Committee member 1: “Based on overall performance, it is clear that manager Y was the best performing manager given the 96 basis points.”

(b) Committee member 2: “All three of the managers were hired because they claimed that they had the ability to capitalize on corporate credit opportunities. Although they have all outperformed the benchmark, I am concerned about the claims that they made when we retained them.”

(c) Committee member 3: “It seems that managers X and Z were able to outperform the benchmark without taking on any interest rate risk at all.”

Risk actor Yield curve risk Swap spread risk Volatility risk Govemment related spread risk35 Corporate spread risk Securitized spread risk Portfolio X Portfolio Y Portfolio Z 92 20 20 25 10 30 40 -2

Step by Step Solution

3.55 Rating (166 Votes )

There are 3 Steps involved in it

a Committee member 1 Below we report totals when the basis points plus and minus are added for all six risk factors Portfolio X Portfolio Y Portfolio Z Total of all 6 risk factors 95 105 90 Based on o... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

518-B-C-F-B-V (1015).docx

120 KBs Word File