A multinational company has two subsidiaries, one in Ireland (local currency = Irish Pound) and the other

Question:

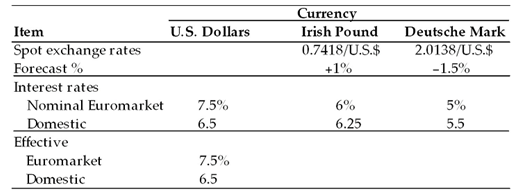

A multinational company has two subsidiaries, one in Ireland (local currency = Irish Pound) and the other in Germany (local currency = Deutsche Mark). Pro forma statements of operations indicate the following short-term financial needs for each subsidiary (in equivalent U.S. dollars): Ireland: $25 million excess cash to be invested (lent to others); Germany: $10 million to be raised (borrowed). The following financial data is also available:

a. Determine the effective rates of interest for the Irish pound and the German mark in both the Euromarket and the domestic market.

b. Where funds should be invested?

c. Where funds should be raised?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: