Question: Amalgamated Engineering plc makes specialized machinery for several industries. In recent years, the company has faced severe competition from overseas businesses, and its sales volume

Amalgamated Engineering plc makes specialized machinery for several industries. In recent years, the company has faced severe competition from overseas businesses, and its sales volume has hardly changed. The company has recently applied for an increase in its bank overdraft limit from £750,000 to £1,500,000. The bank manager has asked you, as the bank’s credit analyst, to look at the company’s application.

You have the following information:

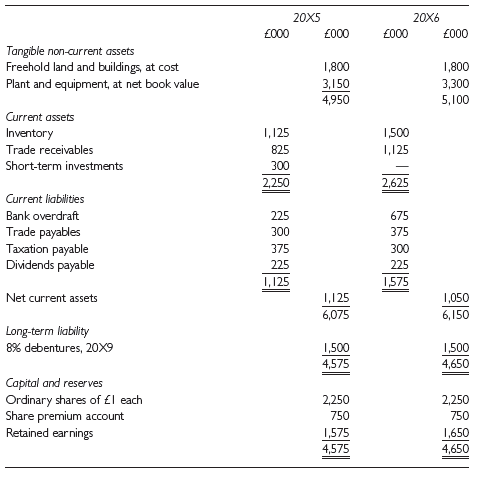

(i) Statements of financial position as at 31 December 20X5 and 20X6:

(ii) Statements of comprehensive income for the years ended 31 December 20X5 and 20X6:

You are also provided with the following information:

(iii) The general price level rose on average by 10% between 20X5 and 20X6. Average wages also rose by 10% during this period.

(iv) The debenture stock is secured by a fixed charge over the freehold land and buildings, which have recently been valued at £3,000,000. The bank overdraft is unsecured.

(v) Additions to plant and equipment in 20X6 amounted to £450,000: depreciation provided in that year was £300,000.

Required:

(a) Prepare a Statement of cash flows for the year ended 31 December 20X6.

(b) Calculate appropriate ratios to use as a basis for a report to the bank manager.

(c) Draft the outline of a report for the bank manager, highlighting key areas you feel should be the subject of further investigation. Mention any additional information you need, and where appropriate refer to the limitations of conventional historical cost accounts.

(d) On receiving the draft report the bank manager advised that he also required the following three cash-based ratios:

(i) Debt service coverage ratio defined as EBITDA/annual debt repayments and interest.

(ii) Cash flow from operations to current liabilities.

(iii) Cash recovery rate defined as ((cash flow from operations proceeds from sale of noncurrent assets)/average gross assets) × 100.

The director has asked you to explain why the bank manager has requested this additional information given that he has already been supplied with profit-basedratios.

20X5 20X6 000 000 000 000 Tangible non-current assets Freehold land and buildings, at cost Plant and equipment, at net book value 1,800 1,800 3,150 3,300 4,950 5,100 Current assets 1,125 1,500 Inventory 1,125 Trade receivables 825 Short-term investments 300 2,250 2,625 Current liabilities Bank overdraft 225 675 Trade payables Taxation payable Dividends payable 300 375 375 300 225 225 1,125 1,575 Net current assets 25, 1,050 6,075 6,150 Long-term liability 1,500 4,575 8% debentures, 20X9 1,500 4,650 Capital and reserves Ordinary shares of l each Share premium account Retained earnings 2,250 2,250 750 750 1,575 1,650 4,575 4,650

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

a Statement of cash flows for year ended 31 December 20X6 000 000 Net cash inflow from operating activities 495 Returns on investing and servicing of finance Interest paid 195 Net cash outflow 195 300 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

168-B-A-G-F-A (1178).docx

120 KBs Word File