Question: Apple Inc. has established a unique reputation in the consumer electronics industry with its development of products such as the iPod, the iPhone, and the

Apple Inc. has established a unique reputation in the consumer electronics industry with its development of products such as the iPod, the iPhone, and the iPad. As of May 2010,

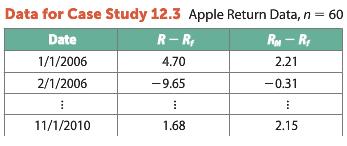

Apple had surpassed Microsoft as the most valuable company in the world (New York Times, May 26, 2010). Michael Gomez is a stock analyst and wonders if the return on Apple’s stock is best modeled using the CAPM model. He collects five years of monthly data, a portion of which is shown. The entire data set, labeled Apple, can be found on the text website.

In a report, use the sample information to:

1. Estimate CAPM: R - Rf + β0 + β1 (RM - Rf) + ε. Search for Apple’s reported Beta on the Web and compare it with your estimate.

2. At the 5% significance level, is the stock return of Apple riskier than that of the market? At the 5% significance level, do abnormal returns exist?Explain.

Data for Case Study 12.3 Apple Return Data, n = 60 Date R-R, Rm- R; 1/1/2006 4.70 2.21 2/1/2006 -9.65 -0.31 11/1/2010 1.68 2.15

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

1 The estimated model is The relevant portion of Excels regression output Coefficients ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

391-M-S-L-R (754).docx

120 KBs Word File