Question: Applied Materials Science (AMS) purchases its materials from several countries. As part of its cost-control program, AMS uses a standard cost system for all aspects

Applied Materials Science (AMS) purchases its materials from several countries. As part of its cost-control program, AMS uses a standard cost system for all aspects of its operations including materials purchases. The company establishes standard costs for materials at the beginning of each fiscal year.

Pat Butch, the purchasing manager, is happy with the result of the year just ended. He believes that the purchase-price variance for the year will be favorable and is very confident that his department has at least met the standard prices. The preliminary report from the controller’s office confirms his jubilation. This is a portion of the preliminary report:

Total quantity purchased .......36,000 kilograms

Average price per kilogram ...... $50

Standard price per kilogram ...... $60

Budgeted quantity per quarter ..... 4,000 kilograms

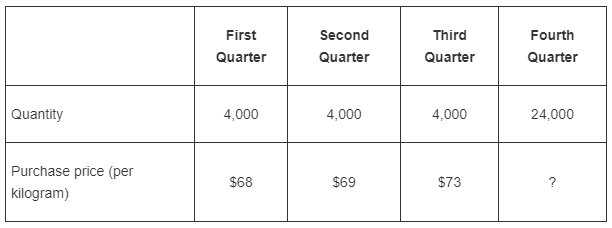

In the fourth quarter, the purchasing department increased purchases from the budgeted normal volume of 4,000 to 24,000 kilograms to meet the increased demands, which was a result of the firm’s unexpected success in a fiercely competitive bidding. The substantial increase in the volume to be purchased forced the purchasing department to search for alternative suppliers. After frantic searches, it found suppliers in several foreign countries that could meet the firm’s needs and could provide materials with higher quality than that of AMS’s regular supplier. The purchasing department, however, was very reluctant to make the purchase because the negotiated price was $76 per kilogram, including shipping and import duty. The actual cost of the purchases, however, was much lower because of currency devaluations before deliveries began, which was a result of the financial turmoil of several countries in the region. Patricia Rice, the controller, does not share the purchasing department’s euphoria. She is fully aware of the following quarterly purchases:

Required

1. Calculate purchase-price variances for the fourth quarter and for the year. How much of the price variance is attributable to changes in foreign currency exchange rates?

2. Evaluate the purchasing department’s performance.

Fourth Quarter First Quarter Second Third Quarter Quarter 4,000 4,000 4,000 Quantity 24,000 Purchase price (per kilogram) $68 $69 $73

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

1 Actual Results Actual Purchase Standard Price Quantity Price Total Cost Price Variance First Quart... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

249-B-M-L-O-M (1104).xlsx

300 KBs Excel File