Arnott Inc. purchased a portfolio of available-for-sale securities in 2012, its first year of operation. The cost

Question:

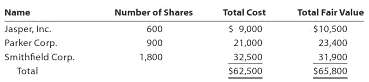

Arnott Inc. purchased a portfolio of available-for-sale securities in 2012, its first year of operation. The cost and fair value of this portfolio on December 31, 2012, was as follows:

On may 10, 2013, Arnott purchased 900 shares of Violet Inc. at $42 per share plus a $125 brokerage fee. a. Provide the journal entries to record the following:1. The adjustment of the available-for-sale security portfolio to fair value on December 31, 2012. 2. The May 10, 2013, purchase of Violet Inc. stock. b. How are unrealized gains and losses treated differently for available-for-sale securities than for tradingsecurities?

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Question Posted: