Question: Assume that Russ Brothers did indeed fail, and that it had the following balance sheet when it was liquidated (in millions of dollars): Athe debentures

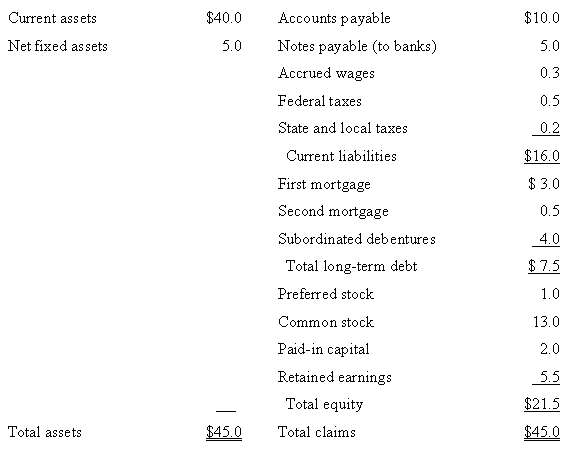

Assume that Russ Brothers did indeed fail, and that it had the following balance sheet when it was liquidated (in millions of dollars):

Athe debentures are subordinated to the notes payable.

The liquidation sales resulted in the following proceeds:

From sale of current assets? ? ? ?$14,000,000

From sale of fixed assets ? ? ? ? ? ? ? ?2,500,000

Total receipts ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? $16,500,000

For simplicity, assume that there were no trustee's fees or any other claims against the liquidation proceeds. Also, assume that the mortgage bonds are secured by the entire amount of fixed assets. What would each claimant receive from the liquidation distribution?

MINI CASE?

Kimberly Mackenzie, president of Kim's Clothes Inc., a medium-sized manufacturer of women's casual clothing, is worried. Her firm has been selling clothes to Russ Brother's department store for more than ten years, and she has never experienced any problems in collecting payment for the merchandise sold. Currently, Russ Brothers owes Kim's Clothes $65,000 for spring sportswear that was delivered to the store just two weeks ago. Kim's concern was brought about by an article that appeared in yesterday's Wall Street Journal that indicated that Russ Brothers was having serious financial problems. Further, the article stated that Russ Brothers' management was considering filing for reorganization, or even liquidation, with a federal bankruptcy court. Kim's immediate concern was whether or not her firm would collect its receivables if Russ Brothers went bankrupt. In pondering the situation, Kim also realized that she knew nothing about the process that firms go through when they encounter severe financial distress. To learn more about bankruptcy, reorganization, and liquidation, Kim asked Ron Mitchell, the firm's chief financial officer, to prepare a briefing on the subject for the entire board of directors. In turn, Ron asked you, a newly hired financial analyst, to do the groundwork for the briefing by answering the following questions: |

Current assets Net fixed assets Total assets $40.0 5.0 $45.0 Accounts payable Notes payable (to banks) Accrued wages Federal taxes State and local taxes. Current liabilities First mortgage Second mortgage Subordinated debentures Total long-term debt Preferred stock Common stock Paid-in capital Retained earnings Total equity Total claims $10.0 5.0 0.3 0.5 0.2 $16.0 $3.0 0.5 4.0 $7.5 1.0 13.0 2.0 5.5 $21.5 $45.0

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

The following table shows the liquidation distribution millions of dollars Distribution to Priority ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

9-B-F-M-C (266).docx

120 KBs Word File