Debentures

Debenture Definition

Debentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who need to raise capital can issue debentures against the interest income for the holder.

Issuance Of Debentures

Normally the debentures have a face value of $1,000 or $100 per instrument. It is also called the par value of the debenture. The company, however, has an option to issue the debentures at above or below the face value of the bond. If the debenture is issued at a price that is less than par or face value then it is issued at a discount. If it is issued at a price higher than the par value then it is issued at a premium.

Debenture Example

Company A needs to raise $5,000,000 and has issued 5000, 10 years 8% debentures with a face value of $1,000 debentures. To raise the cash the company is issuing the debentures at 2.5% discount.

At the time of raising the cash, the company will record the following:

Cash $4,875,000

Discount on issuance of debentures $125,000

8% Debentures $5,000,000

At the end of next 10 years the interest will be paid and recorded as follows:

Interest Expense ($5,000,000 x 8%) $400,000

Cash $400,000

At the end of maturity the principal will be paid as follows:

8% Debentures $5,000,000

Cash $5,000,000

Debenture Bonds

The debentures or bonds are loan instruments issued by the borrower to raise capital from general public. Simultaneously, it is an investment for lenders in return for an interest rate offered by the borrower. Bonds and debentures are slightly different with respect to the collateral. Generally bonds are secured against a specific asset of the issuing company.

Corporate Debenture

Corporate debentures are debentures issued by large corporations to raise capital for investment and expansion purposes.

Subordinated Debenture

A subordinated debenture is a debenture that has a lower rank for payment at the time of liquidation of the issuing company. In hierarchy, they are subordinated to a prioritized debenture class the holders of which are paid earlier than other classes in the event of liquidation.

Convertible Debenture

The convertible debentures are hybrid instruments with characteristics of a debt and equity at the same time. The holder of the convertible debenture has an option to convert the debenture into equity shares at the time or before the time of maturity. In that case, at the time of initially recording the debentures, the debt portion and equity portions are separately recorded.

Convertible Debenture Example

Company A needs to raise $2,000,000 and has issued 2000, 8 years 6% debentures with a face value of $1,000 debentures with an option to convert each debenture into 100 equity shares of Company A. A bond with the same maturity is currently offering 7% interest rate.

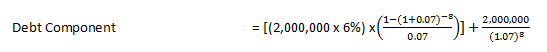

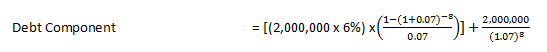

Calculation of Debt and Equity Components

Total worth of the capital raised = $1000 x 2000 debentures = $2,000,000

= $1,880,574

Equity Component = Total amount raised – debt component

= $2,000,000 - $1,880,574 = $119,426

The following entry will be passed at the time of recoding convertible debentures:

Cash $2,000,000

6% Debentures $1,880,574

Equity $119,426