Question: Assume the same information as in IFRS17-12 except that Roosevelt has an active trading strategy for these bonds. The fair value of the bonds at

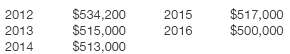

Assume the same information as in IFRS17-12 except that Roosevelt has an active trading strategy for these bonds. The fair value of the bonds at December 31 of each year-end is as follows.

Instructions(a) Prepare the journal entry at the date of the bond purchase.(b) Prepare the journal entries to record the interest received and recognition of fair value for 2012.(c) Prepare the journal entry to record the recognition of fair value for2013.

$517,000 $500,000 $534,200 $515,000 $513,000 2012 2015 2013 2016 2014

Step by Step Solution

3.29 Rating (178 Votes )

There are 3 Steps involved in it

a January 1 2012 Debt Investments 53790740 Cash 53790740 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-I (186).docx

120 KBs Word File