At time zero the price of a non-dividend-paying stock is S 0 . Suppose that the time

Question:

At time zero the price of a non-dividend-paying stock is S0. Suppose that the time interval between 0 and T is divided into two subintervals of length t1 and t2. During the first subinterval, the risk-free interest rate and volatility are r1 and σ1, respectively. During the second subinterval, they are r2 and σ2, respectively. Assume that the world is risk neutral.

(a) Use the results in Chapter 15 to determine the stock price distribution at time T in terms of r1, r2, σ1, σ2, t1, t2, and S0.

(b) Suppose that r̅ is the average interest rate between time zero and T and that V̅ is the average variance rate between times zero and T. What is the stock price distribution as a function of T in terms of r̅, V̅, T, and S0?

(c) What are the results corresponding to (a) and (b) when there are three subintervals with different interest rates and volatilities?

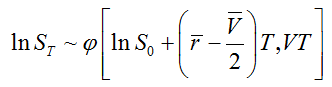

(d) Show that if the risk-free rate, r, and the volatility, σ, are known functions of time, the stock price distribution at time T in a risk-neutral world is

where r̅ is the average value of r, V̅ is equal to the average value of σ2, and S0 is the stock price today.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer: