Holmes Corporation is a leading designer and manufacturer of material handling and processing equipment for heavy industry

Question:

Holmes Corporation is a leading designer and manufacturer of material handling and processing equipment for heavy industry in the United States and abroad. Its sales have more than doubled, and its earnings have increased more than sixfold in the past five years. In material handling, Holmes is a major producer of electric overhead and gantry cranes, ranging from 5 tons in capacity to 600-ton giants, the latter used primarily in nuclear and conventional power-generating plants. It also builds under hung cranes and monorail systems for general industrial use carrying loads up to 40 tons, railcar movers, railroad and mass transit shop maintenance equipment, and a broad line of advanced package conveyors. Holmes is a world leader in evaporation and crystallization systems and furnishes dryers, heat exchangers, and filters to complete its line of chemical processing equipment sold internationally to the chemical, fertilizer, food, drug, and paper industries. For the metallurgical industry, it designs and manufactures electric arc and induction furnaces, cupolas, ladles, and hot metal distribution equipment.

The information below and on the following pages appears in the Year 15 annual report of Holmes Corporation.

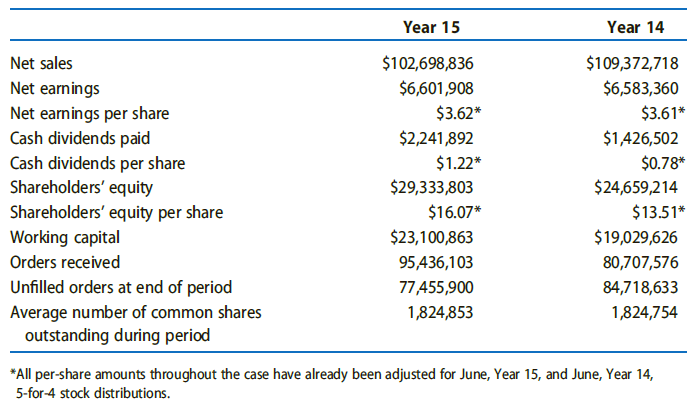

HIGHLIGHTS

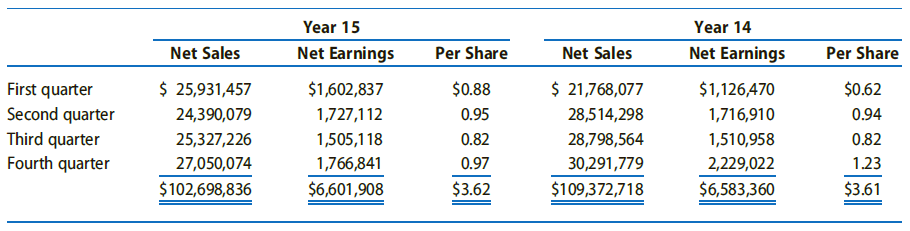

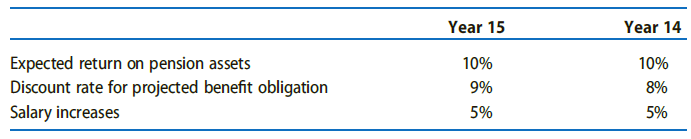

Net Sales, Net Earnings, and Net Earnings per Share by Quarter

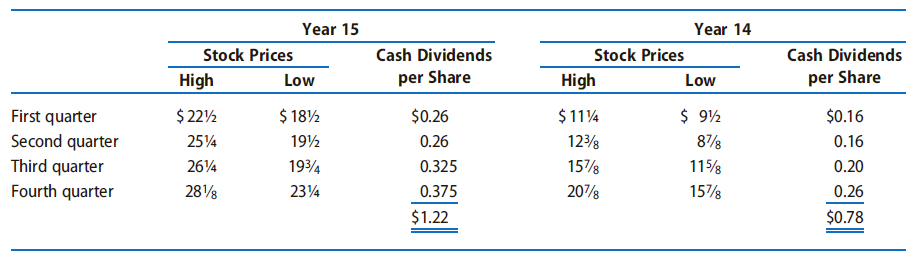

Common Stock Prices and Cash Dividends Paid per Common Share by Quarter

Common Stock Prices and Cash Dividends Paid per Common Share by Quarter

?

?

Management's Report to Shareholders?Year 15 was a pleasant surprise for all of us at Holmes Corporation. When the year started, it looked as though Year 15 would be a good year but not up to the record performance of Year 14. However, due to the excellent performance of our employees and the benefit of a favorable acquisition, Year 15 produced both record earnings and the largest cash dividend outlay in the company's 93-year history.There is no doubt that some of the attractive orders received in late Year 12 and early Year 13 contributed to Year 15 profit. But of major significance was our organization's favorable response to several new management policies instituted to emphasize higher corporate profitability. Year 15 showed a net profit on net sales of 6.4%, which not only exceeded the 6.0% of last year but represents the highest net margin in several decades.Net sales for the year were $102,698,836, down 6% from the $109,372,718 of a year ago but still the second largest volume in our history. Net earnings, however, set a new record at $6,601,908, or $3.62 per common share, which slightly exceeded the $6,583,360, or $3.61 per common share, earned last year.Cash dividends of $2,241,892 paid in Year 15 were 57% above the $1,426,502 paid a year ago. The record total resulted from your Board's approval of two increases during the year. When we implemented the 5-for-4 stock distribution in June, Year 15, we maintained the quarterly dividend rate of $0.325 on the increased number of shares for the January payment. Then, in December, Year 15, we increased the quarterly rate to $0.375 per share.Year 15 certainly was not the most exuberant year in the capital equipment markets. Fortunately, our heavy involvement in ecology improvement, power generation, and international markets continued to serve us well, with the result that new orders of $95,436,103 were 18% over the $80,707,576 of Year 14.Economists have predicted a substantial capital spending upturn for well over a year, but, so far, our customers have displayed stubborn reluctance to place new orders amid the uncertainty concerning the economy. Confidence is the answer. As soon as potential buyers can see clearly the future direction of the economy, we expect the unleashing of a large latent demand for capital goods, producing a much-expanded market for Holmes' products.Fortunately, the accelerating pace of international markets continues to yield new business. Year 15 was an excellent year on the international front as our foreign customers continue to recognize our technological leadership in several product lines. Net sales of Holmes products shipped overseas and fees from foreign licensees amounted to $30,495,041, which represents a 31% increase over the $23,351,980 of a year ago.Management fully recognizes and intends to take maximum advantage of our technological leadership in foreign lands. The latest manifestation of this policy was the acquisition of a controlling interest in Societe´ Francaise Holmes Fermont, our Swenson process equipment licensee located in Paris. Holmes and a partner started this firm 14 years ago as a sales and engineering organization to function in the Common Market. The company currently operates in the same mode. It owns no physical manufacturing assets, subcontracting all production. Its markets have expanded to include Spain and the East European countries.Holmes Fermont is experiencing strong demand in Europe. For example, in early May, a $5.5 million order for a large potash crystallization system was received from a French engineering company representing a Russian client. Management estimates that Holmes Fermont will contribute approximately $6 to $8 million of net sales in Year 16.Holmes' other wholly owned subsidiaries-Holmes Equipment Limited in Canada; Ermanco Incorporated in Michigan; and Holmes International, Inc., our FSC (Foreign Sales Corporation)- again contributed substantially to the success of Year 15. Holmes Equipment Limited registered its second-best year. However, capital equipment markets in Canada have virtually come to a standstill in the past two quarters. Ermanco achieved the best year in its history, while Holmes International, Inc., had a truly exceptional year because of the very high level of activity in our international markets.The financial condition of the company showed further improvement and is now unusually strong as a result of very stringent financial controls. Working capital increased to $23,100,863 from $19,029,626, a 21% improvement. Inventories decreased 6% from $18,559,231 to $17,491,741. The company currently has no long-term or short-term debt, and has considerable cash in short-term instruments. Much of our cash position, however, results from customers' advance payments, which we will absorb as we make shipments on the contracts. Shareholders' equity increased 19% to $29,393,803 from $24,690,214 a year ago.Plant equipment expenditures for the year were $1,172,057, down 18% from $1,426,347 of Year 14. Several appropriations approved during the year did not require expenditures because of delayed deliveries beyond Year 15. The major emphasis again was on our continuing program of improving capacity and efficiency through the purchase of numerically controlled machine tools. We expanded the Ermanco plant by 50%, but since this is a leasehold arrangement, we made only minor direct investments. We also improved the Canadian operation by adding more manufacturing space and installing energy-saving insulation.Labor relations were excellent throughout the year. The Harvey plant continues to be nonunion. We negotiated a new labor contract at the Canadian plant, which extends to March 1, Year 17. The Pioneer Division in Alabama has a labor contract that does not expire until April, Year 16. While the union contract at Ermanco expired June 1, Year 15, work continues while negotiation proceeds on a new contract. We anticipate no difficulty in reaching a new agreement.We exerted considerable effort during the year to improve Holmes' image in the investment community. Management held several informative meetings with security analyst groups to enhance the awareness of our activities and corporate performance.The outlook for Year 16, while generally favorable, depends in part on the course of capital spending over the next several months. If the spending rate accelerates, the quickening pace of new orders, coupled with present backlogs, will provide the conditions for another fine year. On the other hand, if general industry continues the reluctant spending pattern of the last two years, Year 16 could be a year of maintaining market positions while awaiting better market conditions. Management takes an optimistic view and thus looks for a successful Year 16.The achievement of record earnings and the highest profit margin in decades demonstrates the capability and the dedication of our employees. Management is most grateful for their efforts throughout the excellent year.T. R. Varnum ? ? ? ? ? ? ? ? ? T. L. FullerPresident ? ? ? ? ? ? ? ? ? ? ? ?ChairmanMarch 15, Year 16Review of OperationsYear 15 was a very active year although the pace was not at the hectic tempo of Year 14. It was a year that showed continued strong demand in some product areas but a dampened rate in others. The product areas that had some special economic circumstances enhancing demand fared well. For example, the continuing effort toward ecological improvement fostered excellent activity in Swenson processing equipment. Likewise, the energy concern and the need for more electrical power generation capacity boded well for large overhead cranes. On the other hand, Holmes' products that relate to general industry and depend on the overall capital spending rate for new equipment experienced lesser demand, resulting in lower new orders and reduced backlogs. The affected products were small cranes, underhung cranes, railcar movers, and metallurgical equipment.Year 15 was the first full year of operations under some major policy changes instituted to improve Holmes' profitability. The two primary revisions were the restructuring of our marketing effort along product division lines and the conversion of the product division incentive plans to a profit-based formula. The corporate organization adapted extremely well to the new policies. The improved profit margin in Year 15, in substantial part, was a result of the changes.International activity increased markedly during the year. Surging foreign business and the expressed objective to capitalize on Holmes' technological leadership overseas resulted in the elevation of Mr. R. E. Foster to officer status as Vice President-International. The year involved heavy commitments of the product division staffs, engineering groups, and manufacturing organization to such important contracts as the $14 million Swenson order for Poland, the $8 million Swenson project for Mexico, the $2 million crane order for Venezuela, and several millions of dollars of railcar movers for all areas of the world.The acquisition of control and commencement of operating responsibility of Socie´te´ Française Holmes Fermont, the Swenson licensee in Paris, was a major milestone in our international strategy. This organization has the potential of becoming a very substantial contributor in the years immediately ahead. Its long-range market opportunities in Europe and Asia are excellent.

Material Handling ProductsMaterial handling equipment activities portrayed conflicting trends. During the year, when total backlog decreased, the crane division backlog increased. This was a result of several multi milliondollar contracts for power plant cranes. The small crane market, on the other hand, experienced depressed conditions during most of the year as general industry withheld appropriations for new plant and equipment. The underhung crane market experienced similar conditions. However, as congressional attitudes and policies on investment unfold, we expect capital spending to show a substantial upturn.The Transportation Equipment Division secured the second order for orbital service bridges, a new product for the containment vessels of nuclear power plants. This design is unique and allows considerable cost savings in erecting and maintaining containment shells.The Ermanco Conveyor Division completed its best year with the growing acceptance of the unique XenoROL design. We expanded the Grand Haven plant by 50% to effect further cost reduction and new concepts of marketing.The railcar moving line continued to produce more business from international markets. We installed the new 11TM unit in six domestic locations, a product showing signs of exceptional performance. We shipped the first foreign 11TM machine to Sweden.Processing Equipment ProductsProcessing equipment again accounted for slightly more than half of the year's business. Swenson activity reached an all-time high level with much of the division's effort going into international projects. The large foreign orders required considerable additional work to cover the necessary documentation, metrification when required, and general liaison.We engaged in considerably more subcontracting during the year to accommodate one-piece shipment of the huge vessels pioneered by Swenson to effect greater equipment economies. The division continued to expand the use of computerization for design work and contract administration. We developed more capability during the year to handle the many additional tasks associated with turnkey projects. Swenson's research and development efforts accelerated in search of better technology and new products. We conducted pilot plant test work at our facilities and in the field to convert several sales prospects into new contracts.The metallurgical business proceeded at a slower pace in Year 15. However, with construction activity showing early signs of improvement and automotive and farm machinery manufacturers increasing their operating rates, we see intensified interest in metallurgical equipment.

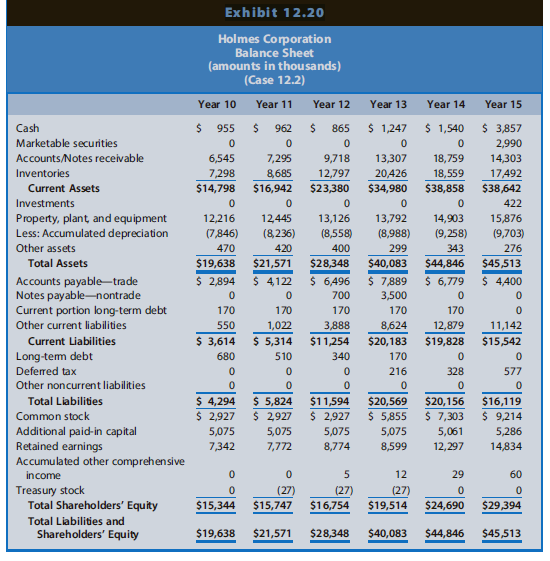

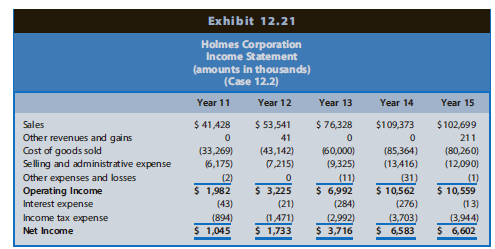

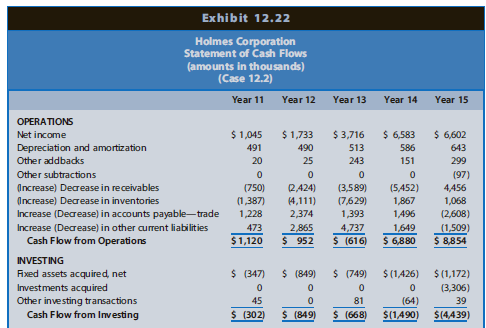

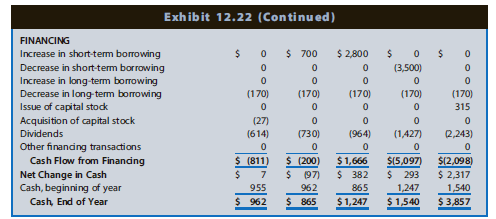

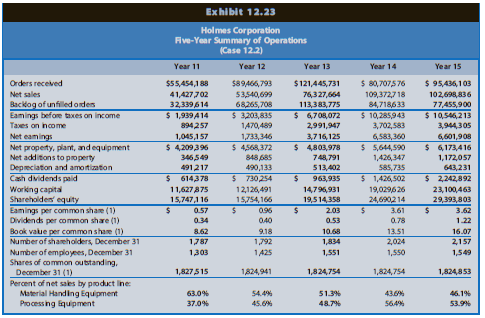

Financial Statements

The financial statements of Holmes Corporation and related notes appear in Exhibits 12.20 to 12.22 . Exhibit 12.23 resents five-year summary operating information for Holmes.

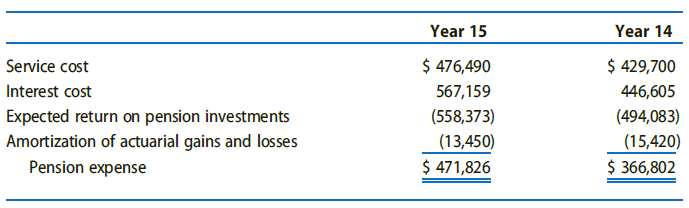

Notes to Consolidated Financial Statements Year 15 and Year 14Note A-Summary of Significant Accounting Policies.Significant accounting policies consistently applied appear below to assist the reader in reviewing the company's consolidated financial statements contained in this report.ConsolidationThe consolidated financial statements include the accounts of the company and its subsidiaries after eliminating all intercompany transactions and balances.InventoriesInventories generally appear at the lower of cost or market, with cost determined principally on a first-in, first-out method.Property, plant, and equipmentProperty, plant, and equipment appear at acquisition cost minus accumulated depreciation. When the company retires or disposes of properties, it removes the related costs and accumulated depreciation from the respective accounts and credits, or charges any gain or loss to earnings. The company expenses maintenance and repairs as incurred. It capitalizes major betterments and renewals. Depreciation results from applying the straight-line method over the estimated useful lives of the assets as follows:Buildings 30 to 45 years Machinery and equipment 4 to 20 years Furniture and fixtures 10 yearsIntangible assetsThe company has amortized the un allocated excess of cost of a subsidiary over net assets acquired (that is, goodwill) over a 17-year period. Beginning in Year 16, U.S. GAAP no longer requires amortization of goodwill.Research and development costsThe company charges research and development costs to operations as incurred ($479,410 in Year 15 and $467,733 in Year 14).Pension plansThe company and its subsidiaries have noncontributory pension plans covering substantially all of their employees. The company's policy is to fund accrued pension costs as determined by independent actuaries. Pension costs amounted to $471,826 in Year 15 and $366,802 in Year 14.

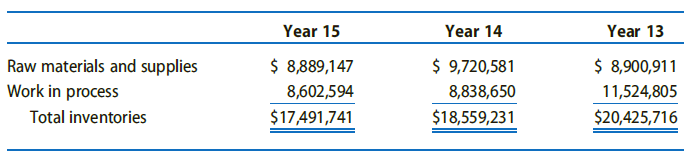

Revenue recognition-The company generally recognizes income on a percentage-of completion basis. It records advance payments as received and reports them as a deduction from billings when earned. The company recognizes royalties, included in net sales, as income when received. Royalties totaled $656,043 in Year 15 and $723,930 in Year 14.Income taxes-The company provides no income taxes on unremitted earnings of foreign subsidiaries because it anticipates no significant tax liabilities should foreign units remit such earnings. The company makes provision for deferred income taxes applicable to timing differences between financial statement and income tax accounting, principally on the earnings of a foreign sales subsidiary, which existing statutes defer in part from current taxation.Note B-Foreign Operations. The consolidated financial statements in Year 15 include net assets of $2,120,648 ($1,847,534 in Year 14), undistributed earnings of $2,061,441 ($1,808,752 in Year 14), sales of $7,287,566 ($8,603,225 in Year 14), and net income of $454,999 ($641,454 in Year 14) applicable to the Canadian subsidiary. The company translates balance sheet accounts of the Canadian subsidiary into U.S. dollars at the exchange rates at the end of the year and translates operating results at the average of exchange rates for the year.Note C-Inventories. Inventories used in determining cost of sales appear below. Note D-Short-Term Borrowing. The company has short-term credit agreements that principally provide for loans of 90-day periods at varying interest rates. There were no borrowings in Year 15. In Year 14, the maximum borrowing at the end of any calendar month was $4,500,000 and the approximate average loan balance and weighted-average interest rate, computed by using the days outstanding method, were $3,435,000 and 7.6%. There were no restrictions upon the company during the period of the loans and no compensating bank balance arrangements required by the lending institutions.Note E-Income Taxes. Provision for income taxes consists of:

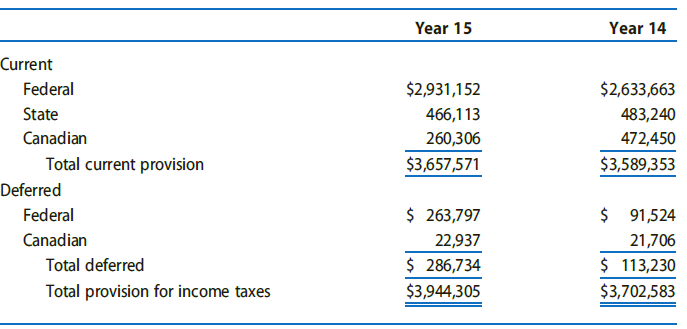

Note D-Short-Term Borrowing. The company has short-term credit agreements that principally provide for loans of 90-day periods at varying interest rates. There were no borrowings in Year 15. In Year 14, the maximum borrowing at the end of any calendar month was $4,500,000 and the approximate average loan balance and weighted-average interest rate, computed by using the days outstanding method, were $3,435,000 and 7.6%. There were no restrictions upon the company during the period of the loans and no compensating bank balance arrangements required by the lending institutions.Note E-Income Taxes. Provision for income taxes consists of:

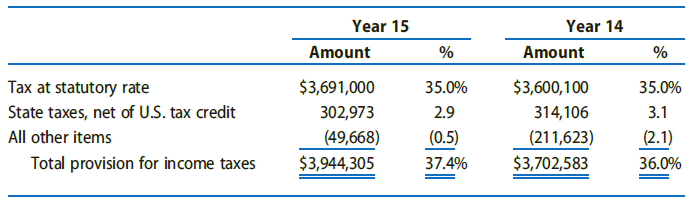

Reconciliation of the total provision for income taxes to the current federal statutory rate of 35% is as follows:

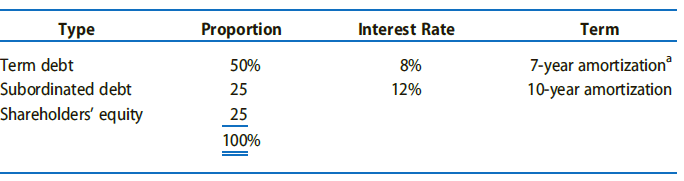

Note F'Pensions. The components of pension expense appear below.

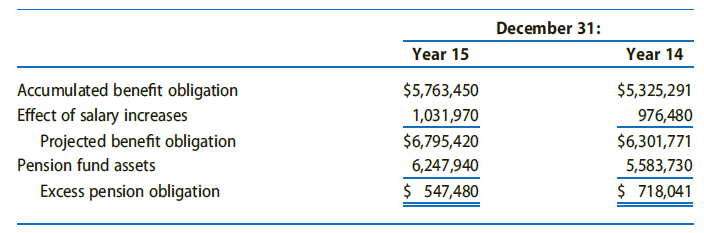

The funded status of the pension plan appears below.

Assumptions used in accounting for pensions appear below.

Note G-Common Stock. As of March 20, Year 15, the company increased the authorized number of shares of common stock from 1,800,000 shares to 5,000,000 shares. On December 29, Year 15, the company increased its equity interest (from 45% to 85%) in Socie´te´ Française Holmes Fermont, a French affiliate, in exchange for 18,040 of its common shares in a transaction accounted for as a purchase. The company credited the excess of the fair value ($224,373) of the company's shares issued over their par value ($90,200) to additional contributed capital. The excess of the purchase cost over the underlying value of the assets acquired was insignificant.The company made a 25% common stock distribution on June 15, Year 14, and on June 19, Year 15, resulting in increases of 291,915 shares in Year 14 and 364,433 shares in Year 15, respectively.We capitalized the par value of these additional shares by a transfer of $1,457,575 in Year 14 and $1,822,165 in Year 15 from retained earnings to the common stock account. In Year 14 and Year 15, we paid cash of $2,611 and $15,340, respectively, in lieu of fractional share interests.In addition, the company retired 2,570 shares of treasury stock in June, Year 14. The earnings and dividends per share for Year 14 and Year 15 in the accompanying consolidated financial statements reflect the 25% stock distributions.Note H-Contingent Liabilities. The company has certain Contingent Liabilities with respect to litigation and claims arising in the ordinary course of business. The company cannot determine the ultimate disposition of these Contingent Liabilities but, in the opinion of management, they will not result in any material effect upon the company's consolidated financial position or results of operations.Note I-Quarterly Data (unaudited). Quarterly sales, gross profit, net earnings, and earnings per share for Year 15 appear below (first quarter results restated for 25% stock distribution):

Auditors' Report?

Board of Directors and Stockholders?

Holmes Corporation?We have examined the consolidated balance sheets of Holmes Corporation and Subsidiaries as of December 31, Year 15 and Year 14, and the related consolidated statements of earnings and cash flows for the years then ended. Our examination was made in accordance with generally accepted auditing standards and accordingly included such tests of the accounting records and such other auditing procedures as we considered necessary in the circumstances. In our opinion, the financial statements referred to above present fairly the consolidated financial position of Holmes Corporation and Subsidiaries at December 31, Year 15 and Year 14, and the consolidated results of their operations and changes in cash flows for the years then ended, in conformity with generally accepted accounting principles applied on a consistent basis.SBW, LLP Chicago, Illinois March 15, Year 16?

REQUIRED?

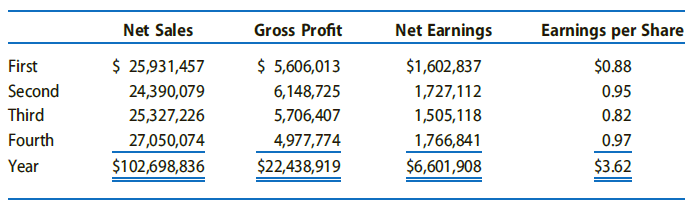

A group of Holmes' top management is interested in acquiring Holmes in an LBO.a. Briefly describe the factors that make Holmes an attractive and, conversely, an unattractive LBO candidate.b. (This question requires coverage of Chapter 10.) Prepare projected financial statements for Holmes Corporation for Year 16 through Year 20 excluding all financing. That is, project the amount of operating income after taxes, assets, and cash flows from operating and investing activities. State the underlying assumptions made.c. Ascertain the value of Holmes' common shareholders' equity using the present value of its future cash flows valuation approach. Assume a risk-free interest rate of 4.2% and a market premium of 5.0%. Note that information in Requirement e may be helpful in this valuation. Assume the following financing structure for the LBO:

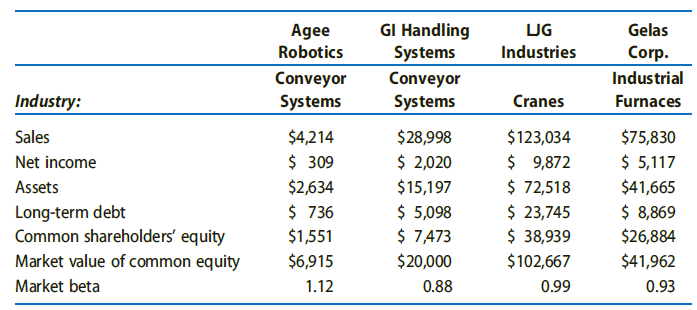

Holmes must repay principal and interest in equal annual payments.d. (This question requires coverage of Chapter 13.) Ascertain the value of Holmes' common shareholders' equity using the residual income approach.e. (This question requires coverage of Chapter 14.) Ascertain the value of Holmes' common shareholders' equity using the residual ROCE model and the price-to-earnings ratio and the market value to book value of comparable companies' approaches. Selected data for similar companies for Year 15 appear in the following table (amounts in millions):

f. Would you attempt to acquire Holmes Corporation after completing the analyses in Requirements a-e? If not, how would you change the analyses to make this an attractive LBO?

Contingent liabilitiesA contingent liability is an obligation of business related to an uncertain future event. The business must record it in its financial statements if the amount can be reliably estimated and it is probable that amount will be paid by business as a... Intangible Assets

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw