Question: Background info for this question- The chief executive officer of Ginny's Fashion has included the following financial statements in a loan application submitted to priority

Background info for this question- The chief executive officer of Ginny's Fashion has included the following financial statements in a loan application submitted to priority bank. The company intends to acquire additional equipment and wishes to finance the purchase with a long-term note. Assume that you, a bank loan officer, review the financial statements and recommend whether Ginny's Fashions should be considered for a loan. Support your recommendations with financial ratios. Assume a tax rate of 30%. Interest expense is $2,000 in 2012 and $2,000 in 2011.

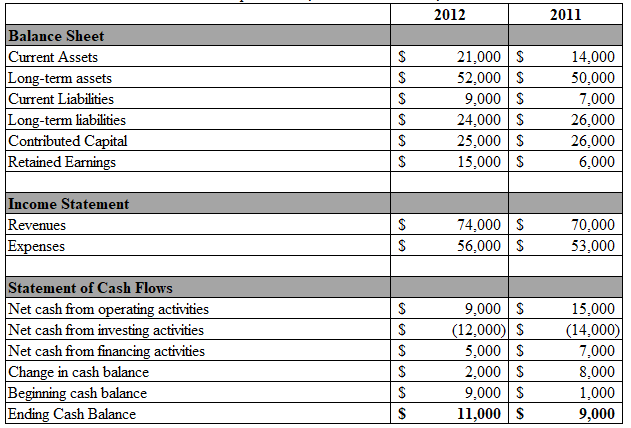

2011 2012 Balance Sheet Current Assets Long-term assets Current Liabilities Long-term liabilities Contributed Capital Retained Earnings 21,000 S 14,000 52,000 S 50,000 7,000 9,000 S 24,000 S 25,000 S 15,000 S 26,000 26,000 6,000 Income Statement Revenues Expenses 74,000 S 70,000 53,000 56,000 S Statement of Cash Flows Net cash from operating activities Net cash from investing activities Net cash from financing activities Change in cash balance Beginning cash balance Ending Cash Balance 9,000 S 15,000 (12,000) S 5,000 S 2,000 S 9,000 S 11,000 S (14,000) 7,000 8,000 1,000 9,000

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Based on the information provided by Ginnys Fashions we can compute the following ratios First we need to find the 2012 2012 Averages are not consider... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

68-B-C-F-C-C (69).xlsx

300 KBs Excel File