Question: Bat, a U.S. corporation, anticipates a contract based on December 2, 2011 discussions to sell heavy equipment to Ram of Scotland for 500,000 British pounds.

Bat, a U.S. corporation, anticipates a contract based on December 2, 2011 discussions to sell heavy equipment to Ram of Scotland for 500,000 British pounds. The equipment is likely to be delivered and the amount collected on March 1, 2012.

In order to hedge its anticipated commitment, Bat entered into a forward contract on December 2 to sell 500,000 British pounds for delivery on March 1. The forward contract meets all the conditions of ASC Topic 815 for a cash flow hedge of an anticipated foreign currency commitment. A 6 percent interest rate is appropriate.

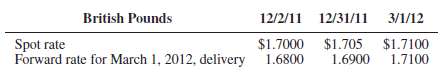

Exchange rates for British pounds on selected dates are as follows:

REQUIRED:Prepare the necessary journal entries on Bat's books to account for:1. The forward contract on December 2, 2011.2. Year-end adjustments relating to the forward contract on December 31, 2011.3. The delivery of the equipment and settlement of all accounts with Ram and the exchange broker on March 1,2012.

British Pounds 12/2/11 12/31/1ii 3/1/12 Spot rate Forward rate for March 1, 2012, delivery $1.7000 $1.705 1.6900 $1.7100 1.6800

Step by Step Solution

3.35 Rating (173 Votes )

There are 3 Steps involved in it

1 2 3 We will assume that the hedge contract is to be settled net December 2 2011 No entry December ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-H-A (24).docx

120 KBs Word File