Question: Before adjustments and closing on December 31, 2011, the current accounts of Seymour and Associates indicated the following balances. The terms of an outstanding long-term

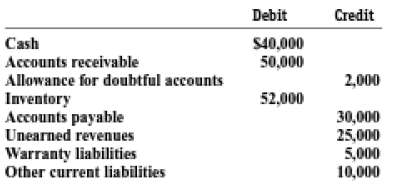

Before adjustments and closing on December 31, 2011, the current accounts of Seymour and Associates indicated the following balances.

The terms of an outstanding long-term note payable stale that Seymour must maintain a current ratio of 2:1 or the note will become due immediately. The following items are not reflected in the balances above:1. Bad debt losses in the amount of 6 percent of the outstanding accounts receivable balance arc expected.2. The warranty liability on outstanding warranties is estimated to be $12,000.3. Forty percent of the unearned revenue had been earned as of December 31.4. Five thousand dollars, listed above under other current liabilities ?? is part of a line of credit and is expected to be immediately refinanced on a tong-term basis when due.5. The total income tax liability for 2011 was estimated at year-end to be $23,000. Estimated tax payments during the year totaled $20,000.6. Trademans, Inc. brought suit against Seymour early in 2011. As of December 31, Seymour's legal counsel estimates that there is a 60 percent probability that the suit will be lost in the amount of $10,000. If the suit is lost, payment will most likely be due in the next yes.REQUIRED:a. Prepare the journal entries that would be recorded (if necessary) for each of the six items listed.b. After preparing the journal entries, compute the company's current ratio, assuming that the contingent liability &scribed in (6) is not accrued.c. After preparing the journal entries, compute the company's current ratio, assuming that the contingent liability &scribed in (6) is accrued.d. If you were Seymour's auditor, would you require that the contingent liability be accrued'Discuss.

Debit Credit Cash S40,000 50,000 Accounts receivable Allowance for doubtful accounts 2,000 Inventory Accounts payable 52,000 30,000 25,000 5,000 10,000 Unearned revenues Warranty liabilities Other current liabilities

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

a 1 Bad Debt Expense E SE 1000 Allowance for Doubtful Accounts A 1000 Estimated bad debts 1000 50000 Accounts receivable balance x 6 Estimated uncollectible percentage 2000 Balance in the Allowance ac... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-L (657).docx

120 KBs Word File