Question: Before adjustments and closing on December 31, 2017, the current accounts of Seymour and Associates indicated the following balances: The terms of an outstanding long-term

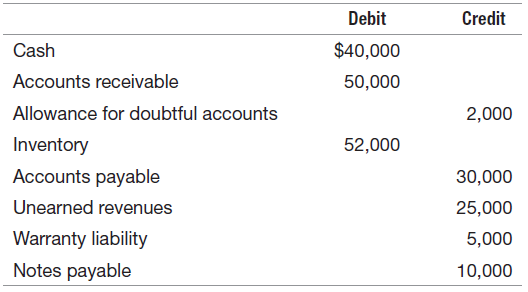

Before adjustments and closing on December 31, 2017, the current accounts of Seymour and Associates indicated the following balances: The terms of an outstanding long-term note payable state that Seymour must maintain a current ratio of 2:1 or the note will become due immediately. The following items are not reflected in the balances above:

The terms of an outstanding long-term note payable state that Seymour must maintain a current ratio of 2:1 or the note will become due immediately. The following items are not reflected in the balances above:

1. Bad debt losses in the amount of 6 percent of the outstanding accounts receivable balance are expected.

2. The warranty liability on outstanding warranties is estimated to be $12,000.

3. 40 percent of the unearned revenue had been earned as of December 31.

4. $5,000, listed above under €œnotes payable,€ is part of a line of credit and is expected to be immediately refinanced on a long-term basis when due.

5. The total income tax payable for 2017 was estimated at year-end to be $23,000. Estimated tax payments during the year totaled $20,000.

6. Trademans Inc. brought suit against Seymour early in 2017. As of December 31, Seymour€™s legal counsel estimates that there is a 60 percent probability that the suit will be lost in the amount of $10,000. If the suit is lost, payment will most likely be due in the next year.

REQUIRED:

a. Prepare the journal entries that would be recorded (if necessary) for each of the six items listed.

b. After preparing the journal entries, compute the company€™s current ratio, assuming that the contingent liability described in (6) is not accrued.

c. After preparing the journal entries, compute the company€™s current ratio, assuming that the contingent liability described in (6) is accrued.

d. If you were Seymour€™s auditor, would you require that the contingent liability be accrued? Discuss.

Debit Credit $40,000 Cash Accounts receivable 50,000 Allowance for doubtful accounts 2,000 Inventory 52,000 Accounts payable 30,000 Unearned revenues 25,000 Warranty liability 5,000 Notes payable 10,000

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

a 1 Bad Debt Expense E SE 1000 Allowance for Doubtful Accounts A 1000 Estimated bad debts 1000 50000 Accounts receivable balance 6 Estimated uncollectible percentage 2000 Balance in the Allowance acco... View full answer

Get step-by-step solutions from verified subject matter experts