Question: Calculating Financial Ratios Based on the balance sheets given for Just Dew It, calculate the following financial ratios for each year: a. Current ratio. b.

Calculating Financial Ratios Based on the balance sheets given for Just Dew It, calculate the following financial ratios for each year:

a. Current ratio.

b. Quick ratio

c. Cash ratio.

d. NWC to total assets ratio.

e. Debt—equity ratio and equity multiplier.

f. Total debt ratio and long-term debt ratio.

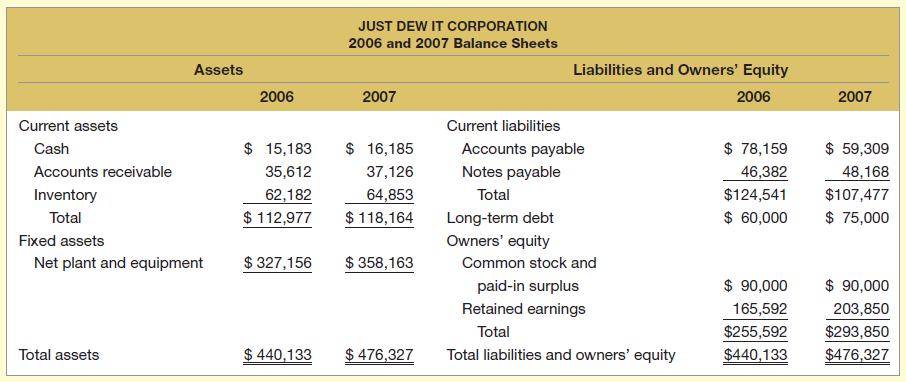

JUST DEW IT CORPORATION 2006 and 2007 Balance Sheets Liabilities and Owners' Equity Assets 2006 2007 2006 2007 Current assets Current liabilities $ 16,185 $ 78,159 $ 15,183 $ 59,309 Cash Accounts payable Accounts receivable 35,612 37,126 Notes payable 46,382 48,168 $107,477 $124,541 Inventory 62,182 64,853 Total $ 118,164 $ 112,977 $ 60,000 $ 75,000 Total Long-term debt Owners' equity Fixed assets $ 358,163 $ 327,156 Net plant and equipment Common stock and $ 90,000 $ 90,000 paid-in surplus Retained earnings 203,850 165,592 Total $255,592 $440,133 $293,850 $476,327 $ 440,133 $ 476,327 Total assets Total liabilities and owners' equity

Step by Step Solution

3.24 Rating (176 Votes )

There are 3 Steps involved in it

a Current ratio Current ratio 2006 Current ratio 2007 b Quick ratio Quick ratio 2006 Quick ratio 200... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-F-S (29).docx

120 KBs Word File