Carol Stoller is the president and sole shareholder of Modern Floors Ltd., a Canadian-controlled private corporation based

Question:

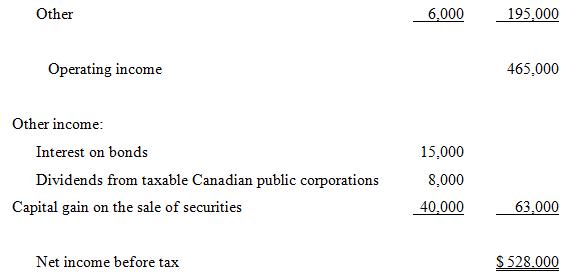

Carol Stoller is the president and sole shareholder of Modern Floors Ltd., a Canadian-controlled private corporation based in your province. It is one month before the company’s year end, and Stoller is reviewing the company’s financial information. The operating results, to date, are good, and her accountant has projected the following results to the end of the fiscal year:

Sales ……………………… | $1,40000,0 | |

Cost of sales …………………………………. | 740,000 | |

Gross profit ………………………………….. | 660,000 | |

Expenses: | ||

Salaries and wages ………………………………….. | $100,000 | |

Rent and utilities…………………………………. | 19,000 | |

Amortization………………………………………… | 8,000 | |

Travel and delivery ……………………… | 17,000 | |

Insurance …………………………………….. | 3,000 | |

Reserve for doubtful debts …………………….. | 22,000 | |

Advertising …………………………………… | 15,000 |

In preparing the year-end projection, the accountant determined the ending inventory based on an estimated value at the lower of cost or market (which is $20,000 lower than the estimate of the inventories cost). Amortization is equal to CCA for tax purposes.

Stoller has noticed that the financial statement does not provide an estimate of the company’s tax liability and has asked her accountant to provide this. Also, the following two developments have taken place that may affect the company’s tax position as well as Stoller’s personal tax position:

• Modern Floors has signed a long-term contract to supply products to a large national chain organization. The contract will begin early in the new year. Operating profits for next year will increase by approximately $180,000.

• Stoller has decided to sell 30% of her common shares in the company to a senior manager for $400,000. She originally purchased the entire share capital of the company seven years ago for $100,000.

While Stoller is pleased with these developments, she is also concerned about their tax consequences. She understands that corporate tax rates increase when a certain level of income is reached. Stoller has never sold any capital property before but is aware that a friend of hers recently sold the shares of his corporation and was entitled to claim a capital gain deduction of $800,000. Stoller now asks you to address these issues and explain what steps, if any, she can take to minimize the overall tax impact on the company and on herself.

Stoller’s personal marginal tax rate is 45%. Assume a provincial corporate general rate of 10% and a small business income rate of 4%.

Required:

1. For the current taxation year, determine the following for Modern Floors: (a) net income for tax purposes; (b) taxable income; and (c) federal and provincial tax payable.

2. Explain to Stoller the tax impact of the projected higher corporate profits for next year.

3. Identify any actions which the corporation can take this year or next year that will be advantageous for the corporation and/or Stoller.

4. Describe the tax consequences to Stoller arising from the proposed sale of shares.

What steps, if any, can she take to minimize any potential tax on the sale?

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold