Claud Chapperon is a self-employed distributor of wholesale clothing who began trading on 1 July 2012. His

Question:

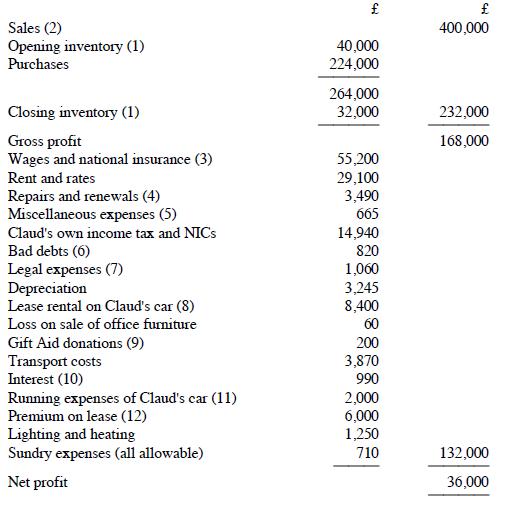

Claud Chapperon is a self-employed distributor of wholesale clothing who began trading on 1 July 2012. His summarised accounts for the year to 30 June 2020 are shown below.

The figures in brackets refer to the notes which follow.

Notes:

1. The basis of both the opening and closing inventory valuations was "lower of cost or market value" less a general reserve of 50%.

2. Sales include £500 reimbursed by Claud's family for clothing taken from stock. The reimbursement represented cost price.

3. Included in wages are Claud's drawings of £200 per week and his wife's wages and secondary NICs totalling £16,750. His wife works full-time in the business.

4. The charge for repairs and renewals includes £3,244 for fitting protective covers over the factory windows and doors to prevent burglary.

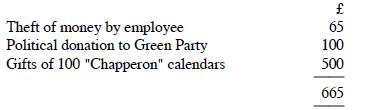

5. Miscellaneous expenses comprise:

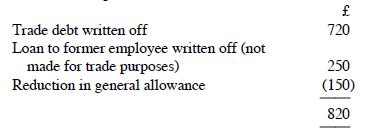

6. Bad debts comprise:

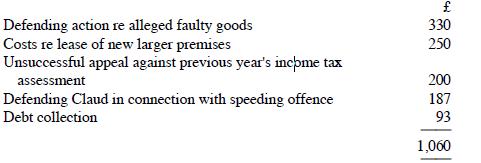

7. Legal expenses comprise:

8. Claud's leased car had a retail price of £20,000 and was leased from 1 July 2019 to 30 June 2020. The car has emissions of 119g/km.

9. Gift Aid donations consist of £120 paid to the local children's hospital and £80 paid to Oxfam. Both payments were made on 30 April 2020.

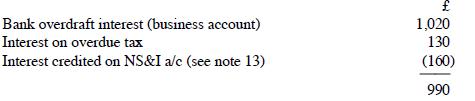

10. Interest is as follows:

11. HM Revenue and Customs has agreed that one-third of Claud's mileage is private.

Included in the charge for motor running expenses is £65 for a speeding fine which was incurred by Claud whilst delivering goods to a customer.

12. The premium was for a lease of six years. The lease began on 1 July 2019.

13. Interest recently credited to the NS&I account is as follows:

The following information is also provided:

(i) Capital allowances for the year to 30 June 2020 are £5,680.

(ii) Claud was born in 1964. He made net contributions of £11,800 to a registered pension scheme during 2020-21. His wife was also born in 1964.

(iii) Claud is a Scottish taxpayer.

You are required:

(a) To prepare a profit adjustment statement in respect of the period of account to 30 June 2020, showing the trading income for 2020-21.

(b) To calculate the Class 4 NICs payable by Claud for 2020-21.

(c) To prepare an estimate of Claud's income tax liability for 2020-21.

Step by Step Answer: