Question: Colombia Textiles began operations several years ago. Its post-closing trial balance at December 31, 2014, is shown below (with accounts listed in alphabetical order): Account

Colombia Textiles began operations several years ago. Its post-closing trial balance at December 31, 2014, is shown below (with accounts listed in alphabetical order):

Account Account Balance’s $000s

Accounts payable..................................................................................... 17

Accounts receivable.................................................................................. 106

Accumulated depreciation, office furniture 38

Accumulated depreciation, store fixtures 61

Brandy Colombia, capital[1]........................................................................ 308

Cash......................................................................................................... 48

Franchise.................................................................................................. 62

Merchandise inventory............................................................................. 236

Notes payable3......................................................................................... 225

Notes receivable4...................................................................................... 14

Office furniture......................................................................................... 52

Office supplies......................................................................................... 5

Prepaid rent.............................................................................................. 32

Store fixtures............................................................................................ 106

Unearned sales......................................................................................... 12

1. Assume all accounts have a normal balance.

2. The owner, Brandy Colombia, made no investments during 2014.

3. $180,000 of the note is due alter December 31, 2015.

4. $3,000 of the notes receivable will be collected during 2015.

Additional information:

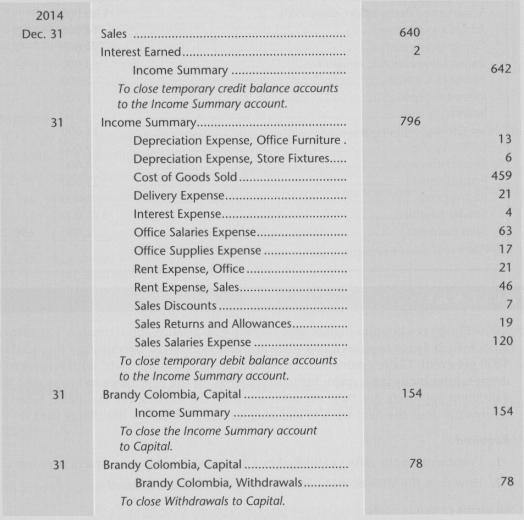

The following closing entries were recorded on December 31, 2014, for the year just ended.

Required

Using the information provided, prepare a single-step income statement, statement of changes in equity, and classified balance sheet.

Analysis Component:

Refer to Danier Leather's June 25, 2011, balance sheet in Appendix II at the back of the textbook. Compare Danier's liabilities to those of Colombia Textiles. Ignoring the balance sheet dates, which company has the stronger balance sheet? (A balance sheet is considered to be stronger the fewer liabilities it has as a percentage of total assets.)

2014 Dec. 31 Sales Interest Earned 640 2 Income Summary 642 To close temporary credit balance account.s to the Income Summary account 31 Income Summary 796 13 Depreciation Expense, Office Furniture Depreciation Expense, Store Fixtures. Cost of Goods Sold Delivery Expense Interest Expense Office Salaries Expense Office Supplies Expense. Rent Expense, Office . .". Rent Expense, Sales 459 21 4 63 17 21 46 19 120 Sales Returns and Allowances Sales Salaries Expense... To close temporary debit balance accounts to the Income Summory account 31 randy Colombia, Capital 154 154 To close the Income Summary account to Capital. 31 Brandy Colombia, Capital 78 78 Brandy Colombia, Withdrawals. To close Withdrawals to Capital

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Singlestep income statement 1 21 46 120 6 193 2 63 17 21 13 114 3 Calculated as postclosing capital ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

734-B-A-A-P (1426).docx

120 KBs Word File