Question: A company is considering buying a new piece of machinery. A 10% interest rate will be used in the computations. Two models of the machine

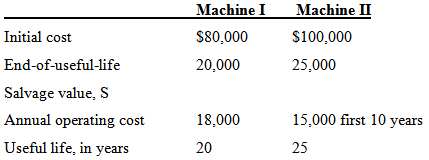

A company is considering buying a new piece of machinery. A 10% interest rate will be used in the computations. Two models of the machine are available.

(a) Determine which machine should be purchased, based on equivalent uniform annual cost.

(b) What is the capitalized cost of Machine I?

(c) Machine I is purchased and a fund is set up to replace Machine I at the end of 20 years. Compute the required uniform annual deposit.

(d) Machine I will produce an annual saving of material of $28,000. What is the rate of return if Machine I is installed?

(e) What will be the book value of Machine I after 2 years, based on sum-of- years' -digits depreciation? if) What will be the book value of Machine n after 3 years, based on double declining balance depreciation?

(g) Assuming that Machine n is in the 7-year property class, what would be the MACRS depreciation in the third year?

Machine II Machine I Initial cost $100,000 $80,000 End-of-useful-life Salvage value, S Annual operating cost Useful life, in years 25,000 20,000 15,000 first 10 years 18,000 25 20

Step by Step Solution

3.29 Rating (173 Votes )

There are 3 Steps involved in it

a EUAC I P S AP i n Si Annual operating cost 80000 20000 AP 10 20 20000 010 18000 60000 01175 2000 18000 27050 EUAC II 100000 25000 AP 10 25 25000 010 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (332).docx

120 KBs Word File