Question: Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percentowned subsidiary Oakley Co. follow: Additional Information for Fiscal Year 2011 Iverson and

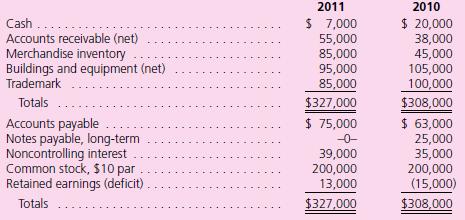

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent–owned subsidiary Oakley Co. follow:

Additional Information for Fiscal Year 2011

Additional Information for Fiscal Year 2011

• Iverson and Oakley’s consolidated net income was $45,000.

• Oakley paid $5,000 in dividends during the year. Iverson paid $12,000 in dividends.

• Oakley sold $11,000 worth of merchandise to Iverson during the year.

• There were no purchases or sales of long-term assets during the year.

In the 2011 consolidated statement of cash flows for Iverson Company:

Net cash flows from operating activities were

a. $12,000.

b. $20,000.

c. $24,000.

d. $25,000.

2011 2010 $ 7,000 55,000 85,000 95,000 85,000 $327,000 $ 20,000 38,000 45,000 105,000 100,000 $308,000 Cash ... Accounts receivable (net) Merchandise inventory Buildings and equipment (net) Trademark Totals Accounts payable ... Notes payable, long-term Noncontrolling interest Common stock, $10 par Retained earnings (deficit) $ 75,000 $ 63,000 25,000 35,000 200,000 (15,000) $308,000 -0- 39,000 200,000 13,000 Totals $327,000 2...

Step by Step Solution

3.30 Rating (159 Votes )

There are 3 Steps involved in it

d Cash flow from operations Net income 45000 Depreciation 100... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

326-B-M-A-S-C-F (2773).docx

120 KBs Word File