Question: Comparing Performance Evaluation Methods Top management of the Gates Corporation is trying to construct a performance evaluation system to use to evaluate each of its

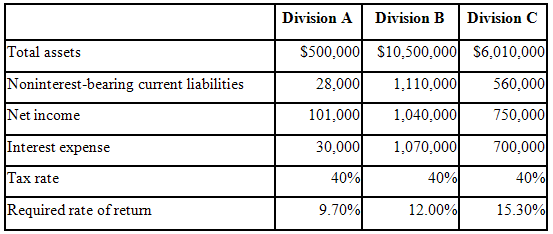

Comparing Performance Evaluation Methods Top management of the Gates Corporation is trying to construct a performance evaluation system to use to evaluate each of its three divisions. This past year’s financial data are as follows:

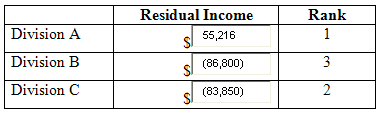

How would the divisions be ranked (from best to worst performance) if the evaluation were based on residual income?

Division B Division A Division C S500,000 s10,500,000 $6,010,000 Total assets 28,000 1,110,000| 560,000| Noninterest-bearing current liabilities 1,040,000 750,000 Net income 101,000 Interest expense 1,070,000 700,000 30,000 40% 40% Tax rate 40% 9.70% 15.30%| Required rate of return 12.00%

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Computation of the residual Income Particulars A B C Total assets 5000... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

68-B-M-A-P-E (86).docx

120 KBs Word File