Question: CompCity, Inc., sells computer hardware. It also markets related software and software-support services. The company prepares annual forecasts for sales, of which the first six

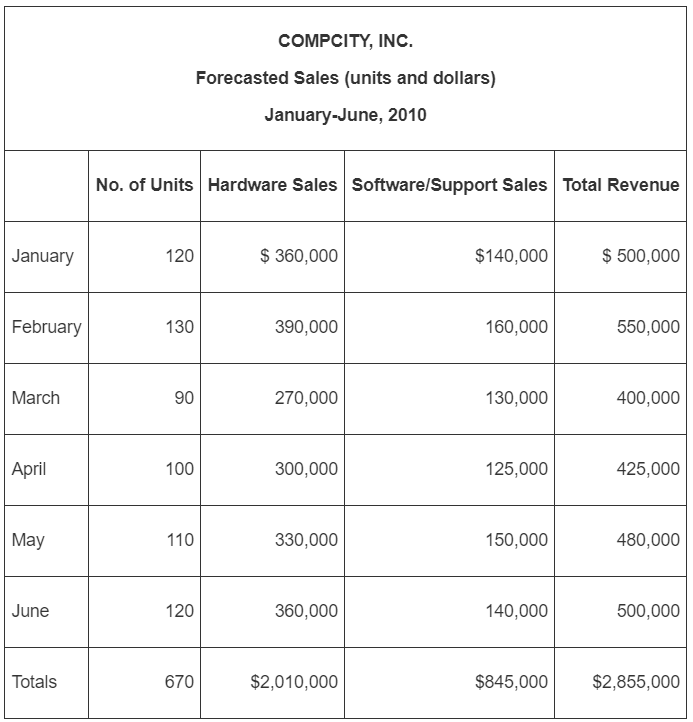

CompCity, Inc., sells computer hardware. It also markets related software and software-support services. The company prepares annual forecasts for sales, of which the first six months of 2010 are given below. In a typical month, total sales are broken down as follows: cash sales, 25 percent; VISA ® credit card sales, 55 percent; and 20 percent open account (the company's own charge accounts). For budgeting purposes, assume that cash sales plus bank credit card sales are received in the month of sale; bank credit card sales are subject to a 3 percent processing fee, which is deducted daily at the time of deposit into CompCity's cash account with the bank. Cash receipts from collection of accounts receivable typically occur as follows: 25 percent in the month of sale, 45 percent in the month following the month of sale, and 27 percent in the second month following the month of sale. The remaining receivables generally turn out to be uncollectible. CompCity's month-end inventory requirements for computer hardware units are 30 percent of the following month's estimated sales. A one-month lead time is required for delivery from the hardware distributor. Thus, orders for computer hardware units are generally placed by CompCity on the 25th of each month to ensure availability in the store on the first day of the month needed.

These units are purchased on credit, under the following terms: n/45, measured from the time the units are delivered to CompCity. Assume that CompCity takes the maximum amount of time to pay its invoices. On average, the purchase price for hardware units runs 65 percent of selling price.

Required

1. Calculate estimated cash receipts for April 2010 (show details).

2. The company wants to estimate the number of hardware units to order on January 25th.

a. Determine the estimated number of units to be ordered.

b. Calculate the dollar cost (per unit and total) for these units.

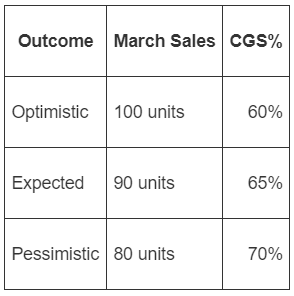

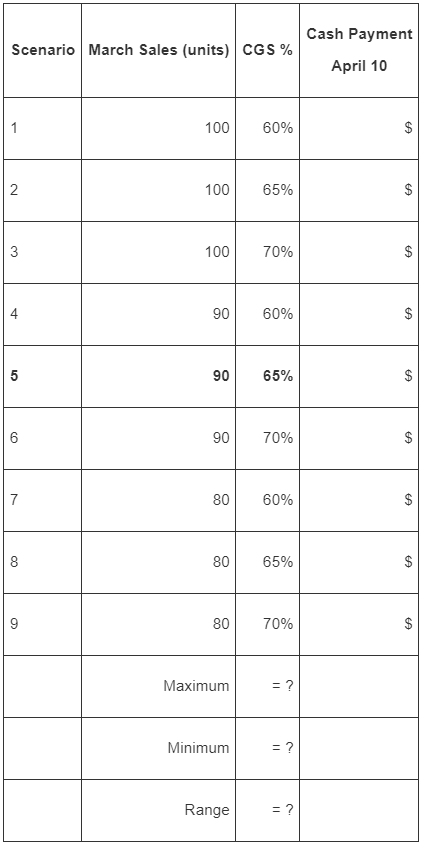

3. Cash planning in this line of business is critical to success. Management feels that the assumption of selling price per unit ($3,000) is firm-at least for the foreseeable future. Also, it is comfortable with the 30 percent rate for end-of-month inventories. It is not so sure, however, about (a) the CGS rate (because of the state of flux in the supplier market), and (b) the level of predicted sales in March 2010. Discussions with marketing and purchasing suggest that three outcomes are possible for each of these two variables, as follows:

The preceding outcomes are assumed to be independent, which means that there are nine possible combinations (3 X 3). You are asked to conduct a sensitivity analysis to determine the range of possible cash outflows for April 10 th , under different combinations of the above. Assume, for simplicity, that sales volume for April is fixed. Complete the following table:

4. As part of the annual budget process, CompCity, Inc., prepares a cash budget by month for the entire year. Explain why a company such as CompCity would prepare monthly cash-flow budgets for the entire year. Explain the role of sensitivity analysis in the monthly planning process.

COMPCITY, INC. Forecasted Sales (units and dollars) January-June, 2010 No. of Units Hardware Sales Software/Support Sales Total Revenue $ 360,000 $ 500,000 $140,000 January 120 390,000 160,000 550,000 February 130 March 90 270,000 130,000 400,000 April 100 300,000 125,000 425,000 May 110 330,000 150,000 480,000 360,000 140,000 June 120 500,000 Totals $2,010,000 $845,000 $2,855,000 670

Step by Step Solution

3.44 Rating (176 Votes )

There are 3 Steps involved in it

1 Estimated Cash Receipts April 2010 April Cash Receipts April cash sales 250 x 425000 106250 April creditcard sales 425000 x 55 x 97 226738 Collectio... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

249-B-M-L-P (463).xlsx

300 KBs Excel File