Question: Complete the requirements of E22-10 using the direct method. In E22-10 Star land Corporation provided the following comparative balance sheets and income statement. Star land

Complete the requirements of E22-10 using the direct method.

In E22-10

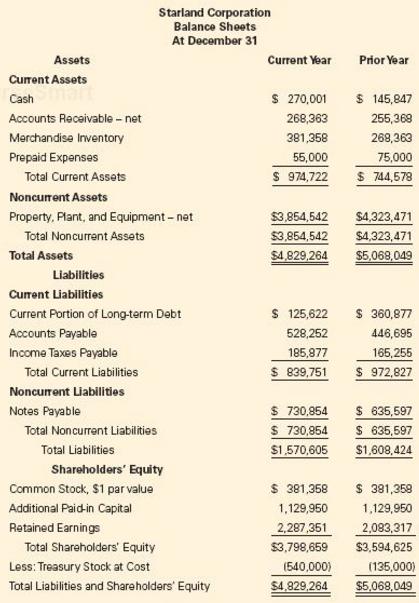

Star land Corporation provided the following comparative balance sheets and income statement.

Star land Corporation

Income Statement

For the Year Ended December 31

Current Year

Sales……………………………………………. $ 1,875,050

Cost of Goods Sold……………………………... 1,125,030

Gross Profit……………………………………… $ 750,020

Selling, General, and Administrative Expenses…. $ 205,000

Bad Debt Expense……………………………….. 4,394

Depreciation Expense……………………………. 39,525

Total Operating Expenses………………………… $ 248,919

Income before Interest and Taxes………………… $ 501,101

Loss on Disposal of Equipment………………….. $ (50,000)

Interest Expense…………………………………... (12,500)

Income before Tax………………………………… $ 438,601

Income Tax Expense………………………………. (175,440)

Net Income………………………………………… $ 263,161

Starland Corporation Balance Sheets At December 31 Assets Current Ye Prior Year Current Assets Cash Accounts Receivable net Merchandise Inventory Prepaid Expenses s 270,001 145,847 255,368 269,363 75,000 S 974,722 744,579 268,363 381,358 55,000 Total Current Assets Noncurrent Assets Property, Plant, and Equipment- net Total Noncurrent Assets Total Assets $3.854,542 ,323,471 $3,854,542 $4 323,471 $4,829,264 $5,068,049 Liabilities Current Liabilities Current Portion of Long-term Debt Accounts Payable Income Taxes Payable S 125,622 360,877 446,695 165,255 S 839,751 972,827 528,252 185.877 Total Current Liabilities Noncurrent Liabilities Notes Payable $ 730,854 635,597 $ 730,854 635,597 $1.570,605 1,608,424 Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital Retained Earnings 381,358 381,359 1,129,950 1129.950 2.287 351 2083317 Total Shareholders' Equity Less: Treasury Stock at Cost Total Liabilities and Shareholders Equity $3,798,659 3,594,625 (135,000) $4.829,264 $5,068,049 (540,000)

Step by Step Solution

3.42 Rating (183 Votes )

There are 3 Steps involved in it

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balance Sheet Changes and Cash Flow Classification Asset... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1958).docx

120 KBs Word File