Question: Computing and interpreting manufacturing unit costs. Minnesota Office Products (MOP) produces three different paper products at the plant. It currently uses the following three-part classification

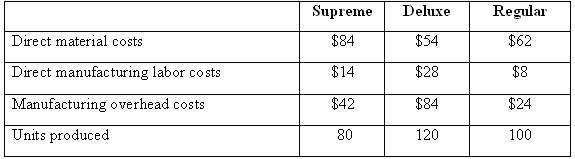

Computing and interpreting manufacturing unit costs. Minnesota Office Products (MOP) produces three different paper products at the plant. It currently uses the following three-part classification for its manufacturing costs; direct materials, direct manufacturing labor, and manufacturing overhead costs. Total manufacturing overhead costs of the plant in July 2008 are $150 million ($20 million of which are fixed). This total amount is allocated to each product line on the basis of the direct manufacturing labor costs of each line. Summary data (in millions) for July 2008 are as follows:

1. Compute the manufacturing cost per unit for each product produced in July 2008.

2. Suppose that in August 2008, production was 120 million units of Supreme, 160 million units of Deluxe, and 180 million units of Regular Why might the July 2008 information on manufacturing cost per unit be misleading when predicting total manufacturing costs in August2008?

Deluxe Regular Supreme Direct material costs $62 $54 $84 $8 Direct manufacturing labor co sts $28 $14 $42 Manufacturing overhead costs $84 $24 Units produced 80 100 120

Step by Step Solution

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Computing and interpreting manufacturing unit costs 1 2 The total manufacturing cost per unit in req... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-A-R (47).docx

120 KBs Word File