Question: Consider the following comparative income statement and additional balance sheet data for Classic Fashions, Inc. Additional data follow: Requirements 1. For 2015 and 2016, compute

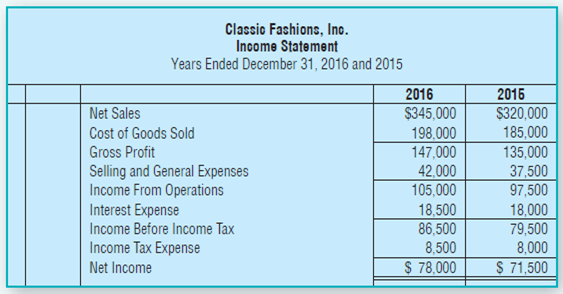

Consider the following comparative income statement and additional balance sheet data for Classic Fashions, Inc.

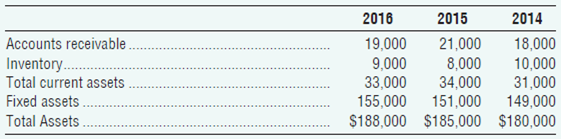

Additional data follow:

Requirements

1. For 2015 and 2016, compute the five ratios that measure how the business is investing its money and whether it is using its assets efficiently. Round each ratio to two decimal places. Assume all sales are on credit.

2. Did the company’s performance improve or deteriorate during 2016?

Classic Fashions, Ino. Income Statement Years Ended December 31, 2016 and 2015 2016 $345,000 2016 Net Sales $320,000 185,000 135,000 37,500 97,500 18,000 79,500 8,000 $ 71,500 Cost of Goods Sold 198.000 147,000 Gross Profit Selling and General Expenses Income From Operations Interest Expense Income Before Income Tax 42,000 105,000 18,500 86,500 8,500 Income Tax Expense $ 78,000 Net Income 2016 2014 Accounts receivable . Inventory. Total current assets Fixed assets. Total Assets. 2015 21,000 8,000 34,000 151,000 19,000 18,000 10,000 9,000 33,000 155,000 31,000 149,000 $188,000 $185,000 $180,000

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Req 1 Req 2 The companys performance improved during ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (3 attachments)

1350_60b9f89b0307f_607957.pdf

180 KBs PDF File

1350-B-M-A-I(3633).xlsx

300 KBs Excel File

1350_60b9f89b0307f_607957.docx

120 KBs Word File