Question: Consider the following simplified APT model (compare Tables 8.3 and 8.4): Calculate the expected return for the following stocks. Assume r f = 5 percent.

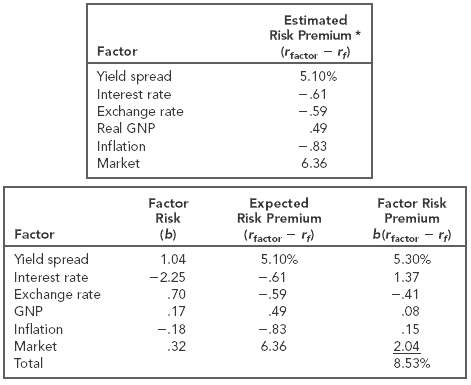

Consider the following simplified APT model (compare Tables 8.3 and 8.4):

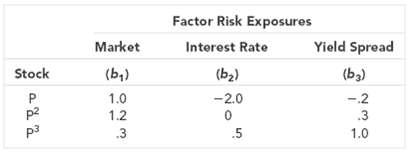

Calculate the expected return for the following stocks. Assume rf = 5 percent.

Estimated Risk Premium* Factor (rtactor - r) Yield spread 5.10% Interest rate -.61 - 59 Exchange rate Real GNP 49 Inflation -.83 Market 6.36 Expected Risk Premium (rfactor - r) Factor Risk Factor Risk Premium (b) b(rtactor - r) Factor Yield spread 1.04 5.10% 5.30% Interest rate -2.25 -.61 1.37 Exchange rate .70 -.59 -41 GNP .17 49 .08 Inflation -18 -.83 .15 Market 6.36 32 2.04 Total 8.53%

Step by Step Solution

3.47 Rating (176 Votes )

There are 3 Steps involved in it

For Stock P r 10 64 20 06 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-R-A-R (133).docx

120 KBs Word File