Question: Consider three mutually exclusive alternatives: Which alternative should be selected? (a) If the minimum attractive rate of return equals 6%? (b) If MARR =9%? (c)

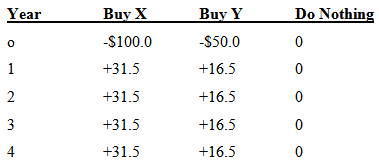

Consider three mutually exclusive alternatives:

Which alternative should be selected?

(a) If the minimum attractive rate of return equals 6%?

(b) If MARR =9%?

(c) If MARR = 10%?

(d) If MARR = 14%?

Buy Y Do Nothing Buy X Year -$100.0 -$50.0 +31.5 +16.5 2 +31.5 +16.5 3 +31.5 +16.5 +31.5 4 +16.5

Step by Step Solution

3.31 Rating (172 Votes )

There are 3 Steps involved in it

Compute rates of return Alternative X 100 315 PA i 4 PA ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (189).docx

120 KBs Word File