Question: Cryptic plc extracted its trial balance on 30 June 20X5 as follows: The following information is relevant: (i) The company discontinued a major activity during

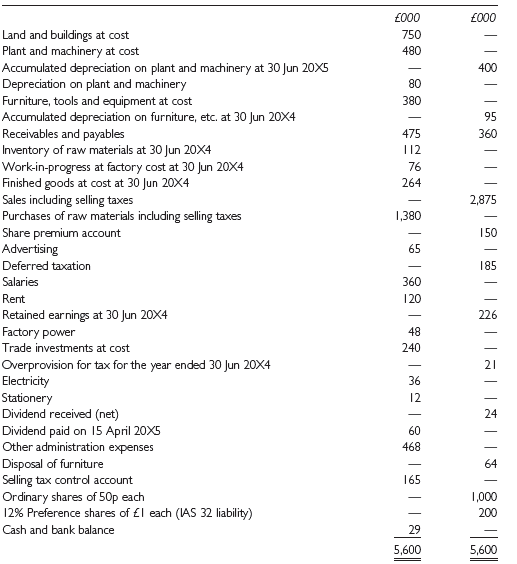

Cryptic plc extracted its trial balance on 30 June 20X5 as follows:

The following information is relevant:

(i) The company discontinued a major activity during the year and replaced it with another. All noncurrent assets involved in the discontinued activity were redeployed for the new one. The following expenses incurred in this respect, however, are included in €˜Other administration expenses€™:

£000

Cancellation of contracts reterminated activity . 165

Fundamental reorganisation arising as a result . 145

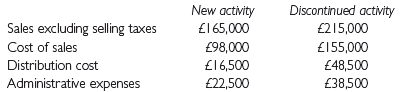

Cryptic has decided to present its results from discontinued operations as a single line on the face of the statement of comprehensive income with analysis in the notes to the accounts as allowed by IFRS 5.

(ii) On 1 January 20X5 the company acquired new land and buildings for £150,000. The remainder of land and buildings, acquired nine years earlier, have NOT been depreciated until this year. The company has decided to depreciate the buildings, on the straight-line method, assuming that one-third of the cost relates to land and that the buildings have an estimated economic life of 50 years. The company policy is to charge a full year of depreciation in the year of purchase and none in the year of sale.

(iii) Plant and machinery was all acquired on 1 July 20X0 and has been depreciated at 10% per annum on the straight-line method. The estimate of useful economic life had to be revised this year when it was realized that if the market share is to be maintained at current levels, the company has to replace all its machinery by 1 July 20X6. The balance in the €˜Accumulated provision for depreciation€™ account on 1 July 20X4 was amended to reflect the revised estimate of useful economic life and the impact of the revision adjusted against the retained earnings brought forward from prior years.

(iv) Furniture acquired for £80,000 on 1 January 20X3 was disposed of for £64,000 on 1 April 20X5. Furniture, tools and equipment are depreciated at 5% p.a. on cost. Depreciation for the current year has not been provided.

(v) Results of the inventor y counting at year-end are as follows:

Inventor y of raw materials at cost including selling tax ... £197,800

Work-in-progress at factor y cost ............. £54,000

Finished goods at cost ................ £364,000

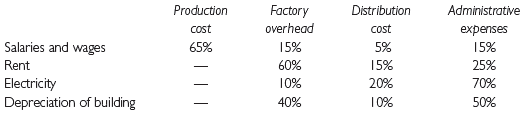

(vi) The company allocates its expenditure as follows:

(vii) The directors wish to make an accrual for audit fees of £18,000 and estimate the income tax for the year at £65,000. £11,000 should be transferred from the deferred tax account. The directors have to pay the preference dividend.

(viii) The following analysis has been made:

(ix) Assume that selling taxes applicable to all purchases and sales is 15%, the basic rate of personal income tax is 25% and the corporate income tax rate is 35%.

Required:

(a) Advise the company on the accounting treatment in respect of information stated in (ii) above.

(b) In respect of the information stated in (iii) above, state whether a company is permitted to revise its estimate of the useful economic life of a non-current asset and comment on the appropriateness of the accounting treatment adopted.

(c) Set out a statement of movement of property, plant and equipment in the year to 30 June 20X5.

(d) Set out for publication the statement of comprehensive income for the year ended 30 June 20X5, the statement of financial position as at that date and any notes other than that on accounting policy, in accordance with relevantstandards.

000 000 Land and buildings at cost 750 Plant and machinery at cost Accumulated depreciation on plant and machinery at 30 Jun 20XS Depreciation on plant and machinery Furniture, tools and equipment at cost Accumulated depreciation on furniture, etc. at 30 Jun 20X4 Receivables and payables Inventory of raw materials at 30 Jun 20X4 Work-in-progress at factory cost at 30 Jun 20X4 Finished goods at cost at 30 Jun 20X4 Sales including selling taxes Purchases of raw materials including selling taxes Share premium account Advertising 480 400 80 380 95 475 360 112 76 264 2,875 1,380 150 65 Deferred taxation 185 Salaries 360 Rent 120 Retained earnings at 30 Jun 20X4 226 Factory power Trade investments at cost 48 240 Overprovision for tax for the year ended 30 Jun 20X4 Electricity Stationery Dividend received (net) Dividend paid on 15 April 20X5 Other administration expenses 21 36 12 24 60 468 Disposal of furniture Selling tax control account Ordinary shares of 50p each 12% Preference shares of l each (IAS 32 liability) 64 165 1,000 200 Cash and bank balance 29 5,600 5,600

Step by Step Solution

3.56 Rating (167 Votes )

There are 3 Steps involved in it

a Requirement Company is wise to depreciate buildings because IAS 16 requires the depreciation of all assets with finite life This would not normally be treated as a change in accounting policy howeve... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

168-B-A-G-F-A (1088).docx

120 KBs Word File