The Blissopia Leisure Group consists of three divisions: Blissopia 1, which operates mainstream bars; Blissopia 2, which

Question:

The Blissopia Leisure Group consists of three divisions: Blissopia 1, which operates mainstream bars; Blissopia 2, which operates large restaurants; and Blissopia 3, which operates one hotel – the Eden.

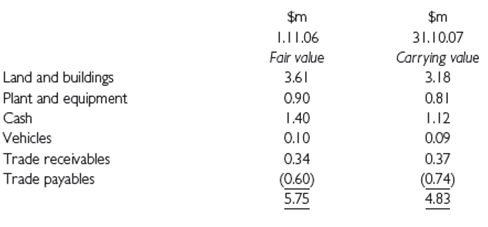

Divisions 1 and 2 have been trading very successfully and there are no indications of any potential impairment. It is a different matter with the Eden however. The Eden is a ‘boutique’ hotel and was acquired on 1 November 2006 for $6.90m. The fair value (using net selling price) of the hotel’s net assets at that date and their carrying value at the year-end were as follows:

The following facts were discovered following an impairment review as at 31 October 2007:

(i) During August 2007, a rival hotel commenced trading in the same location as the Eden. The Blissopia Leisure Group expects hotel revenues to be significantly affected and has calculated the value-in-use of the Eden to be $3.52m.

(ii) The company owning the rival hotel has offered to buy the Eden (including all of the above net assets) for $4m Selling costs would be approximately $50,000.

(iii) One of the hotel vehicles was severely damaged in an accident whilst being used by an employee to carry shopping home from a supermarket. The vehicle’s carrying value at 31 October 2007 was $30,000 and insurers have indicated that as it was being used for an uninsured purpose the loss is not covered by insurance. The vehicle was subsequently scrapped.

(iv) A corporate client, owing $40,000, has recently gone into liquidation. Lawyers have estimated that the company will only receive 25% of the amount outstanding.

Required

Prepare a memo for the directors of the Blissopia Leisure Group explaining how the group should account for the impairment to the Eden Hotel’s assets as at 31 October 2007.

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott