Question: Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: a. Construct NPV profiles for Projects A and B.b.

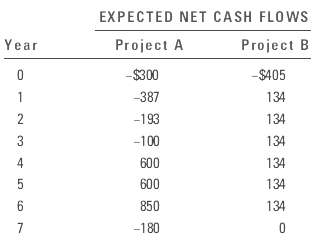

Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows:

a. Construct NPV profiles for Projects A and B.b. What is each project's IRR?c. If you were told that each project's cost of capital was 10%, which project, if either, should be selected? If the cost of capital were 17%, what would be the proper choice?d. What is each project's MIRR at the cost of capital of 10%? At 17%? (Hint: Consider Period 7 as the end of Project B's life.)e. What is the crossover rate, and what is itssignificance?

EXPECTED NET CASH FLOWS Year Project A Project B -$300 -$405 -387 134 1 -193 134 3 -100 134 600 134 4 5 600 134 134 850 -180

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

a b IRR A 181 IRRB 240 c At r 10 Project A has the greater NPV specifically 28334 as compared to Pro... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

49-B-C-F-P-V (56).docx

120 KBs Word File