Danping Corporation, a calendar year taxpayer, sells lawn furniture through big box stores. It manufactures some of

Question:

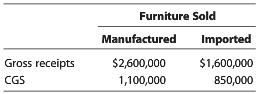

Danping Corporation, a calendar year taxpayer, sells lawn furniture through big box stores. It manufactures some of the furniture and imports some from unrelated foreign producers. For tax year 2015, Danping's records reveal the following information:

Danping also has selling and marketing expenses of $700,000 and administrative expenses of $300,000. Under the simplified deduction method, what is Danping’s:

a. DPGR?

b. QPAI?

c. DPAD?

Transcribed Image Text:

Furniture Sold Manufactured Imported Gross receipts $2,600,000 $1,600,000 850,000 CGS 1,100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 68% (16 reviews)

a 2600000 DPGR cannot include gross receipts from the resale of imported goods b To determin...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

Question Posted:

Students also viewed these Business Law questions

-

Purple Corporation, a calendar year taxpayer, began operations in 2012. It reported the following amounts for its first four tax years. Calculate Purples positive and negative ACE adjustments for...

-

Flicker Corporation, a calendar year taxpayer, manufactures yogurt that it wholesales to grocery stores and other food outlets. The company also operates a yogurt shop near its factory, where it...

-

Wabash Corporation, a calendar year taxpayer, purchases and places into service $400,000 of equipment in Year 1. The equipment is seven-year MACRS property, and the half-year convention applies to...

-

(a) Decide whether each of the following expressions are true or not. Answer yes or no. In any case where it is not true, provide the actual O-complexity. (i) log n = O(n!) (ii) 10! = O(log n) (iii)...

-

How are the Sampsons liquidity and investment decisions related?

-

Given the largecap stock index and the government bond index data in the following table, calculate the expected mean return and standard deviation of return for a portfolio 75 percent invested in...

-

This exercise is based on Section 5.1 of Wu and Hamada [2011]. An experiment to improve a heat treatment process on truck leaf springs was conducted. The heat treatment that forms the camber in leaf...

-

Snowy Mountain manufactures snowboards. Its cost of making 19,000 bindings is as follows: Direct materials ............................................................................... $ 22,000...

-

What could the strategies be for these categories? ugh your research, which will inform your strategic analysis of their importance to the firm's efforts to market and compete within your target...

-

1. In this scenario, management was able to outline some specific characteristics that the resulting technology must have. Is this a good idea? On the one hand, it provides clear criteria against...

-

Citron Corporation has some domestic production gross receipts (DPGR) that qualify for the DPAD and some that do not. a. Is there a safe harbor that allows non-DPGR to be included in DPGR? b. Would...

-

Assume the same facts as in Problem 40, except that Danpings records do not identify its CGS (as between manufactured and imported furniture) but reflect an unallocated amount of $1,950,000. Further...

-

Ridley Company has a factory machine with a book value of $90,000 and a remaining useful life of 4 years. A new machine is available at a cost of $200,000. This machine will have a 4-year useful life...

-

I- A. Consider a Money-in-the-Utility model of the kind we studied in the class with no population growth, i.e., n = 0: A-1) Assume that the aggregate production function is Yt = F(Kt-1,Nt) =Kt-1N-;...

-

4. Consider the graph I in Figure 1. 1. Illustrate Dijkstra's algorithm on the graph I by finding shortest paths to all destinations starting from vertex A. In addition show how parent Of and...

-

What is the theme of The Green Mile?

-

What is the theme of Edward Scissorhands?

-

Our ultimate goal is to advise Bob, the owner of Gerard's Bike Shop, whether he should invest in new, high-tech, tungsten inert gas (TIG) frame welding machinery for his mountain bike building...

-

Problems 143152. The purpose of these problems is to keep the material fresh in your mind so that you are better prepared for later sections, a final exam, or subsequent courses such as calculus....

-

Havel says the grocer doesnt believe what is on the sign and indeed, he says the grocers customers will barely notice it. But Havel maintains that the sign serves a specific function. How would you...

-

Did Goldman have a fiduciary duty to eToys? Did it violate this duty? Goldman Sachs was the lead underwriter for eToys initial public offering. In the IPO, eToys agreed to sell 8,320,000 shares of...

-

Is someone who aids and abets a violation of Section 10(b) liable under the statute? Charter Communications, Inc., a cable operator, engaged in a variety of fraudulent practices to pump up its...

-

David Sokol worked at Berkshire Hathaway for legendary investor Warren Buffett, who is renowned not only for his investment skills but also his ethics. Bankers suggested to both Sokol and the CEO of...

-

Use the information below to answer the questions that follow. U.S. $ EQUIVALENT U.K. pound () 1.5939 Canada dollar (Can$) 1.0091 a. Which would you rather have, $100 or 100? CURRENCY PER U.S. $...

-

What are the molecular mechanisms underlying cellular respiration, and how do they facilitate the conversion of chemical energy stored in organic molecules into adenosine triphosphate (ATP) for...

-

How can advancements in respiratory diagnostics, imaging modalities, and pulmonary rehabilitation techniques enhance our understanding of respiratory pathophysiology and improve clinical management...

Study smarter with the SolutionInn App