Question: Davison Inc. recently hired a new accountant with extensive experience in accounting for partnerships. Because of the pressure of the new job, the accountant was

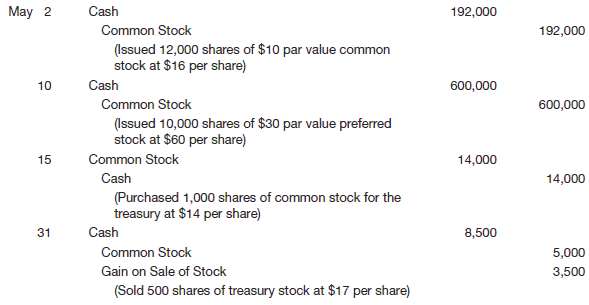

Davison Inc. recently hired a new accountant with extensive experience in accounting for partnerships. Because of the pressure of the new job, the accountant was unable to review what he had learned earlier about corporation accounting. During the first month, he made the following entries for the corporation??s capital stock.

InstructionsOn the basis of the explanation for each entry, prepare the entries that should have been made for thetransactions.

May 2 Cash 192,000 Common Stock 192,000 (Issued 12,000 shares of $10 par value common stock at $16 per share) Cash 600,000 10 Common Stock 600,000 (Issued 10,000 shares of $30 par value preferred stock at $60 per share) Common Stock 15 14,000 Cash 14,000 (Purchased 1,000 shares of common stock for the treasury at $14 per share) Cash 31 8,500 Common Stock 5,000 Gain on Sale of Stock 3,500 (Sold 500 shares of treasury stock at $17 per share)

Step by Step Solution

3.50 Rating (173 Votes )

There are 3 Steps involved in it

May 2 Cash 192000 Common Stock 12000 X 10 120000 Paidin Capital in Excess of Pa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-S-H (194).docx

120 KBs Word File