Question: Differences between the accounting methods applied to accounts and financial reports and those used in determining taxable income yielded the following amounts for the first

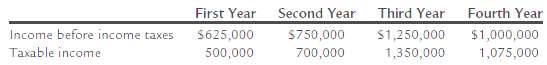

Differences between the accounting methods applied to accounts and financial reports and those used in determining taxable income yielded the following amounts for the first four years of a corporation's operations:

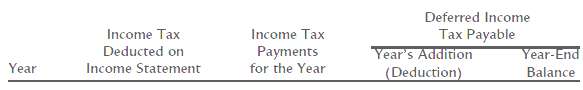

The income tax rate for each of the four years was 40% of taxable income, and each year's taxes were promptly paid.Instructions1. Determine for each year the amounts described by the following captions, presenting the information in the form indicated:

2. Total the first three amount columns.3. Illustrate the effects of recording the current and deferred tax liabilities on the accounts and financial statements for the firstyear.

First Year Second Year S750,000 700,000 Fourth Year Third Year Income before income taxes Taxable income S1,250,000 1,350,000 $1,000,000 1,075,000 $625,000 500,000

Step by Step Solution

3.40 Rating (178 Votes )

There are 3 Steps involved in it

1 and 2 3 Year First Second Third Fourth Total Income Tax Deduc... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-A-S-H (302).docx

120 KBs Word File