Question: The following information about the payroll for the week ended March 17 was obtained from the records of Butte Mining Co.: Instructions1. For the March

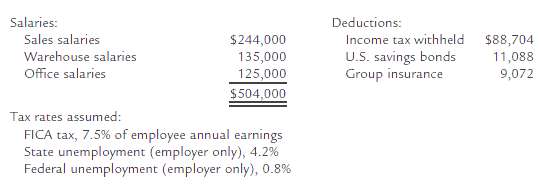

The following information about the payroll for the week ended March 17 was obtained from the records of Butte Mining Co.:

Instructions1. For the March 17 payroll, determine the employee FICA tax payable.2. Illustrate the effect on the accounts and financial statements of paying and recording the March 17 payroll.3. Determine the following amounts for the employer payroll taxes related to the March 17 payroll: (a) FICA tax payable, (b) state unemployment tax payable, and (c) federal unemployment tax payable.4. Illustrate the effect on the accounts and financial statements of recording the liability for the March 17 payroll taxes.

Deductions: Income tax withheld U.S. savings bonds Group insurance Salaries: Sales salaries Warehouse salaries Office salaries $88,704 11,088 9,072 $244,000 125,000 $504,000 Tax rates assumed: FICA tax, 7.5% of employee annual earnings State unemployment (employer only), 4.2% Federal unemployment (employer only), 0.8%

Step by Step Solution

3.32 Rating (167 Votes )

There are 3 Steps involved in it

1 37800 504000 75 2 3 a 37800 504000 75 b 21168 504000 42 c 4032 504000 08 4 Statement of C... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-A-S-H (303).docx

120 KBs Word File