During 2012, its first year of operation, Newton Company purchased two available-for-sale investments as follows: Assume that

Question:

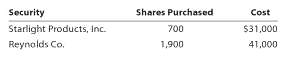

During 2012, its first year of operation, Newton Company purchased two available-for-sale investments as follows:

Assume that as of December 31, 2012, the Starlight Products, Inc., stock had a market value of $55 per share and the Reynolds Co. stock had a market value of $18 per share. Newton Company had net income of $250,000, and paid no dividends for the year ending December 31, 2012.a. Prepare the Current Assets section of the balance sheet presentation for the available-for-sale investments.b. Prepare the Stockholders' Equity section of the balance sheet to reflect the earnings and unrealized gain (loss) for the available-for-sale investments.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren